Do you ever feel vaguely anxious about your finances? If so, you’re not alone.

With the demands of daily life, you may not even have time to keep a household budget. That’s exactly why I recommend the KAKEIBO series for busy individuals like you.

The KAKEIBO series is a meticulously crafted household budgeting tool that I developed by combining my 25 years of experience in budgeting with my Excel expertise. No need to worry about Excel skills! The tool is easy to use with macro functions, and customization is completely free to suit your preferences.

In this article, I’ll thoroughly explain the benefits of the KAKEIBO series and how to choose the right product for you. Why not find the perfect KAKEIBO and start managing your household finances today? Let’s turn household budgeting from “I have to do it” into “It’s fun!“

Language: English Japanese

1. Introduction

In this chapter, I’ll answer the question, “Why is household budgeting more important than ever?” I’ll explain its significance in a clear and relatable way for those who feel vague anxieties about money. Furthermore, I’ll share the background behind the creation of the KAKEIBO series.

1-1 The Importance of Household Budgeting and Modern Challenges

Do you ever feel a vague sense of anxiety about the future? If so, you’re not alone. While daily life can be enjoyable, financial matters often feel unclear. This is precisely why household budgeting is more important than ever. But why does it matter so much now? Because the world around us is undergoing significant changes.

- Diversifying Lifestyles:

With more choices in life — such as marriage, childbirth, and homeownership — spending habits have also diversified. It’s essential to identify what truly matters to you and manage your money wisely. - Information Overload:

The internet and social media are overflowing with information about appealing products and investment opportunities. Without a financial plan, impulsive spending can lead to a shortage of funds when you need them most. - Anxiety about the Future:

Concerns like pension issues and rising living costs create ongoing financial uncertainty. Understanding your finances early allows you to prepare for the future with confidence.

Household budgeting isn’t just about saving money. It’s about understanding your cash flow, cutting unnecessary expenses, and using your money where it truly matters. Like a compass, it guides you through the complexities of financial decisions.

I’ve personally managed my household budget for about 25 years. It all started with a vague anxiety about the future. Once I began budgeting, I identified unnecessary expenses and was able to spend my money on what truly mattered to me. For me, household budgeting is an essential habit for living a fulfilling life.

1-2 The Background of the KAKEIBO Series as an Excel Household Budget

Even if you understand the importance of household budgeting, you might think, “It seems difficult… ” or “I’m not sure I can keep it up… ” Certainly, household budgeting apps with complex features or handwritten budgets can be easy to give up on. That’s why I developed the KAKEIBO series, drawing on my years of household budgeting experience and Excel expertise. But why Excel? There are several reasons.

- High Customizability:

Excel allows for complete customization. You can add the items you need, create graphs, and design your own original household budget. - Familiar Tool:

Many people have experience using Excel for work or other purposes. This eliminates the need to learn a new app, allowing you to start budgeting right away. - Usable Offline:

You can manage your household budget even without an internet connection. This enables you to track your finances anytime, anywhere, without worrying about data usage.

The KAKEIBO series was created by carefully shaping features I found most useful while managing my own household budget. For example, it includes unique functions not found in other household budgeting apps, such as credit card statement reconciliation and a dashboard that provides a clear visual overview of income and expenses.

The KAKEIBO series maximizes Excel’s flexibility and ease of use, making household budgeting more enjoyable and effective. So why not start budgeting with the KAKEIBO series today?

2. The KAKEIBO Series

Finally, the full picture of the KAKEIBO series is revealed! I’ll thoroughly explain the features of PRO, LiGHT, and SLiM. I’ll introduce the functions and usage of each version in detail, so you can confidently answer the question: “Which KAKEIBO is perfect for me?” Let’s find the ideal tool to support your household budgeting!

2-1 Features of Each Series

The KAKEIBO series offers three options to suit your needs: KAKEIBO PRO, KAKEIBO LiGHT, and KAKEIBO SLiM. Each version has unique features, catering to a wide range of users — from beginners in household budgeting to those seeking detailed financial analysis.

KAKEIBO PRO

Do you want a lot of features? Or are you eager to master Excel and perform detailed analyses? If so, KAKEIBO PRO is the perfect choice for you.

Equipped with macros, it offers a wealth of features, including advanced analysis and account management. It also includes unique functions not found in other household budgeting apps, such as credit card reconciliation and bank account transaction management. This makes it ideal for those who want to take household budgeting seriously.

KAKEIBO PRO is like your personal household management system. Its detailed analysis capabilities may seem challenging at first, but once you get the hang of it, managing your household budget becomes much easier. You might even enjoy discovering your own analysis methods, customizing graphs, and fine-tuning your budget through trial and error to create the optimal system for you.

KAKEIBO LiGHT

“I don’t need as many features as PRO, but I still want to manage my budget efficiently.” “I’m not very skilled in Excel, but I want to automate my household budgeting!” If that sounds like you, KAKEIBO LiGHT is the perfect choice.

While it has fewer features than PRO, it still includes essential functions such as the dashboard and aggregation tools. Since it automates processing with macros, it’s easy to use — even without Excel expertise.

KAKEIBO LiGHT is positioned between PRO and SLiM, offering a balanced approach to household budgeting. It’s ideal for those who want simplicity without sacrificing essential functions. Designed with user-friendly operations, it ensures that even those without Excel experience can use it with confidence.

KAKEIBO SLiM

“I want to keep it as simple as possible!” “I’m not good with complicated operations…” “This is my first time managing a household budget!” If that sounds like you, KAKEIBO SLiM is the perfect choice.

By eliminating macros and focusing only on essential features, it prioritizes simplicity. No complex operations are required, making it easy for even Excel beginners to start using immediately.

KAKEIBO SLiM embodies the idea that “simple is best. ” With no complicated functions, even those new to household budgeting can use it with confidence. It’s perfect for those who “want to start budgeting for the first time” or “want an easy way to manage their finances.”

2-2 Detailed Features of KAKEIBO PRO / LiGHT

Both KAKEIBO PRO and KAKEIBO LiGHT come equipped with macros and are designed to make household budgeting easy — even for Excel beginners. Here, I will explain the detailed functions of both versions.

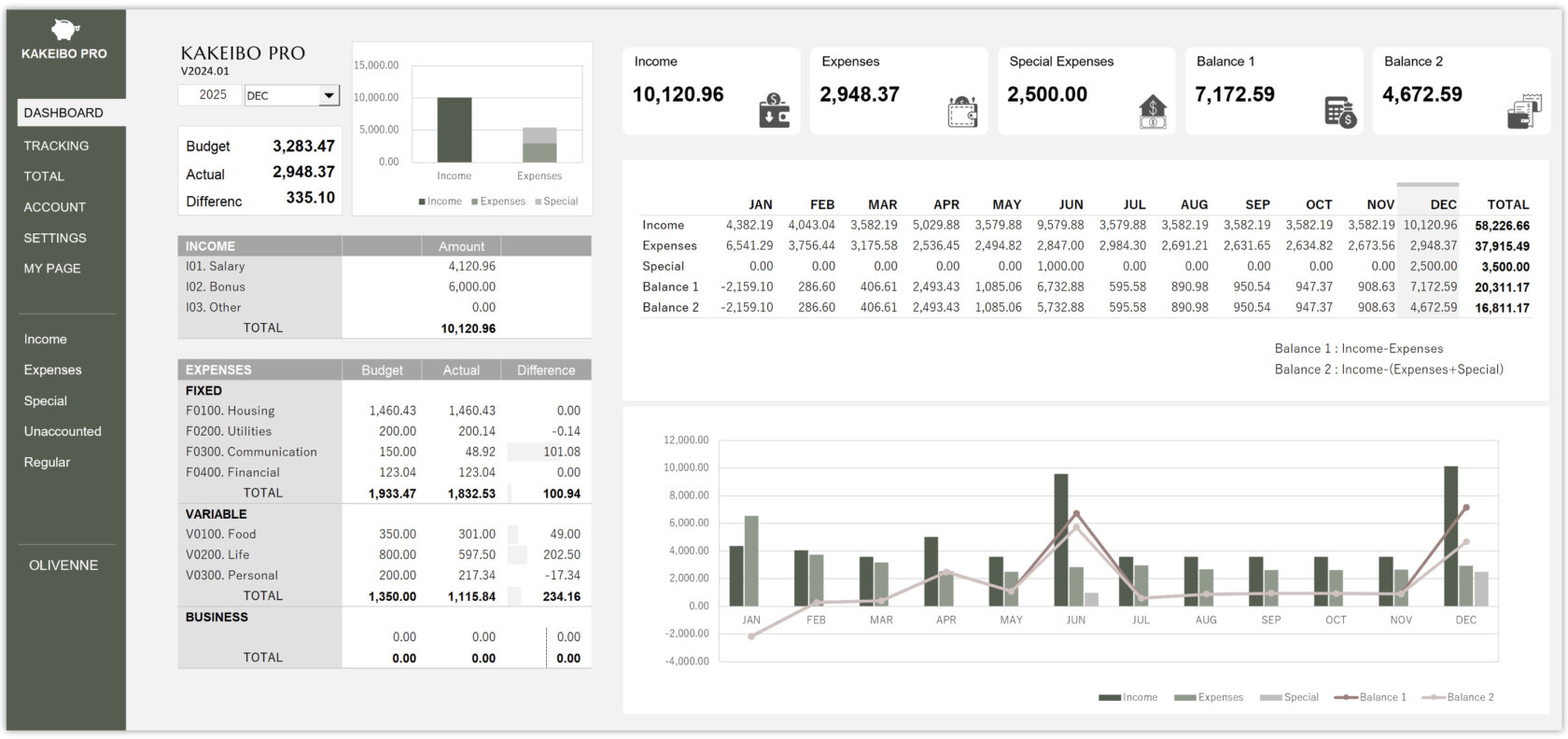

Dashboard

Do you want to see a complete overview of your finances at a glance? The dashboard makes that possible. It displays income, expenses, balances, and more as graphs and tables, both monthly and annually.

- Specify Year and Month: Select any year and month to display aggregated values.

- Budget vs. Actual Expenses: Compare your set budget with actual spending.

- Income vs. Expenses: Visualize income and expenses with a graph.

- Monthly Total of Income: View a breakdown of income by category.

- Monthly Total of Expenses and Budget Management: Analyze expenditures by category and compare them with your budget.

- Summary: Displays income, expenses, and balances in large, easy-to-read fonts.

- Tracking Trends: Monitor annual income and expense trends using graphs.

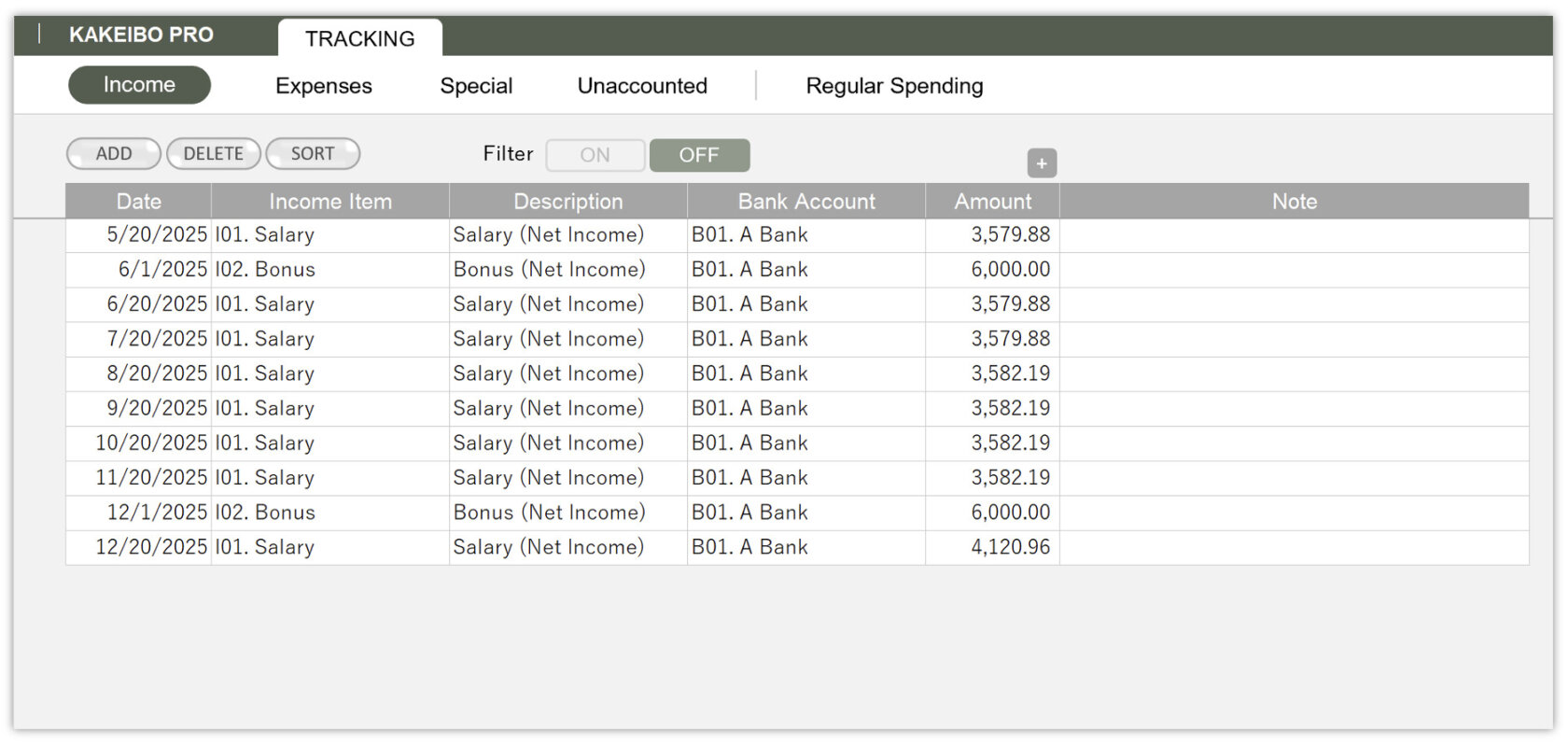

Income and Expenditure Input

Want to record daily transactions effortlessly? With KAKEIBO PRO / LiGHT, you can enter income and expenses across four dedicated sheets: Income, Expenses, Special expenses, and Unaccounted expenses. Data entry is simple, requiring only text input and button clicks.

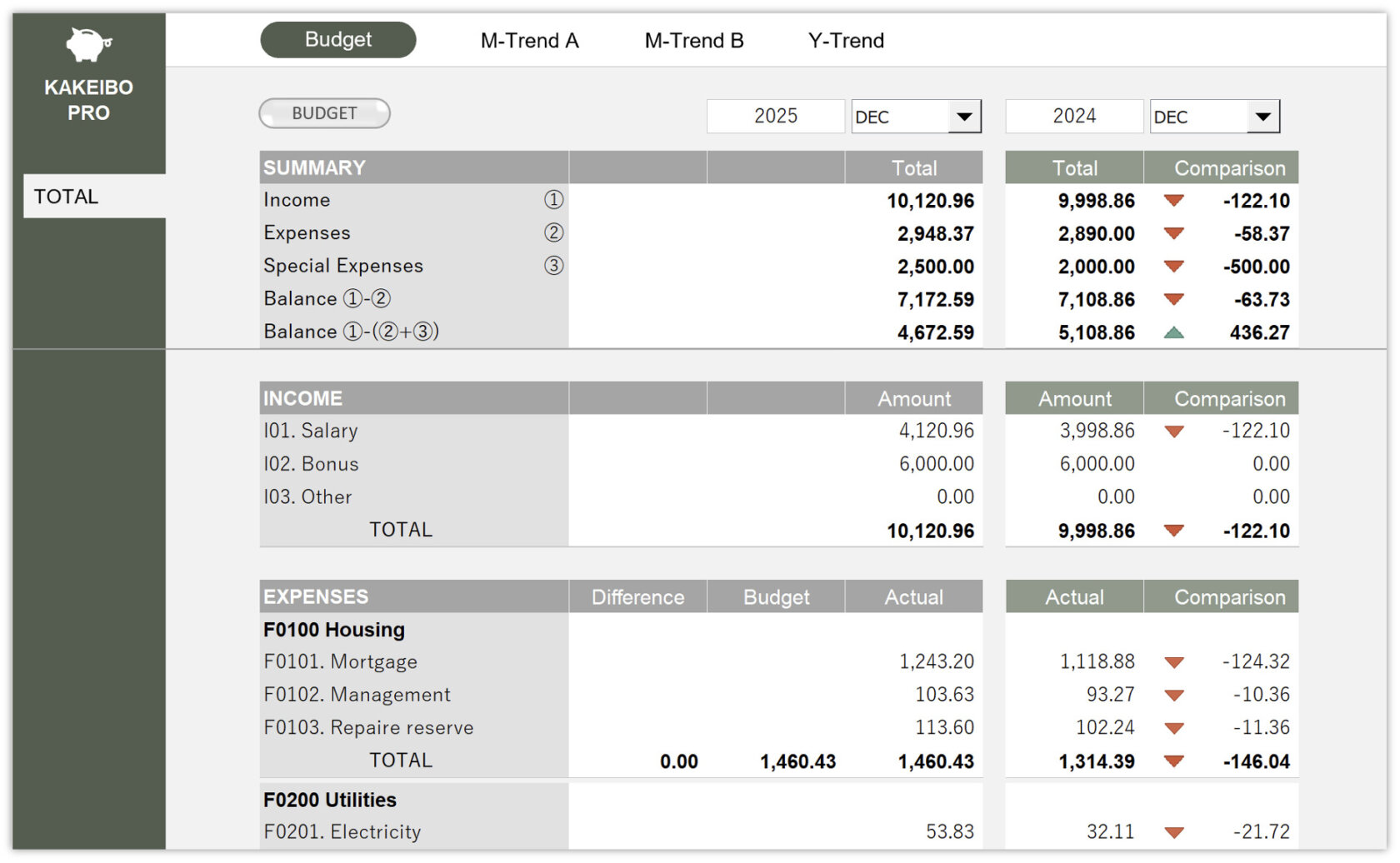

Budget Management

“Am I spending too much this month?” The budget management function helps eliminate such concerns. By setting a budget for each category and comparing it with actual spending, you can prevent overspending. You can also specify a year and month to analyze the balance for that period.

Trend Analysis

“I feel like my food expenses have been increasing lately…” The trend analysis function turns vague feelings into concrete data. By reviewing monthly and annual trends with graphs, you can improve household finances from a long-term perspective.

- Monthly Trend A: Compare trends of specific items across multiple years.

- Monthly Trend B: Track monthly trends for multiple items using bar and line graphs.

- Annual Trend: Analyze annual trends for multiple items with bar and line graphs.

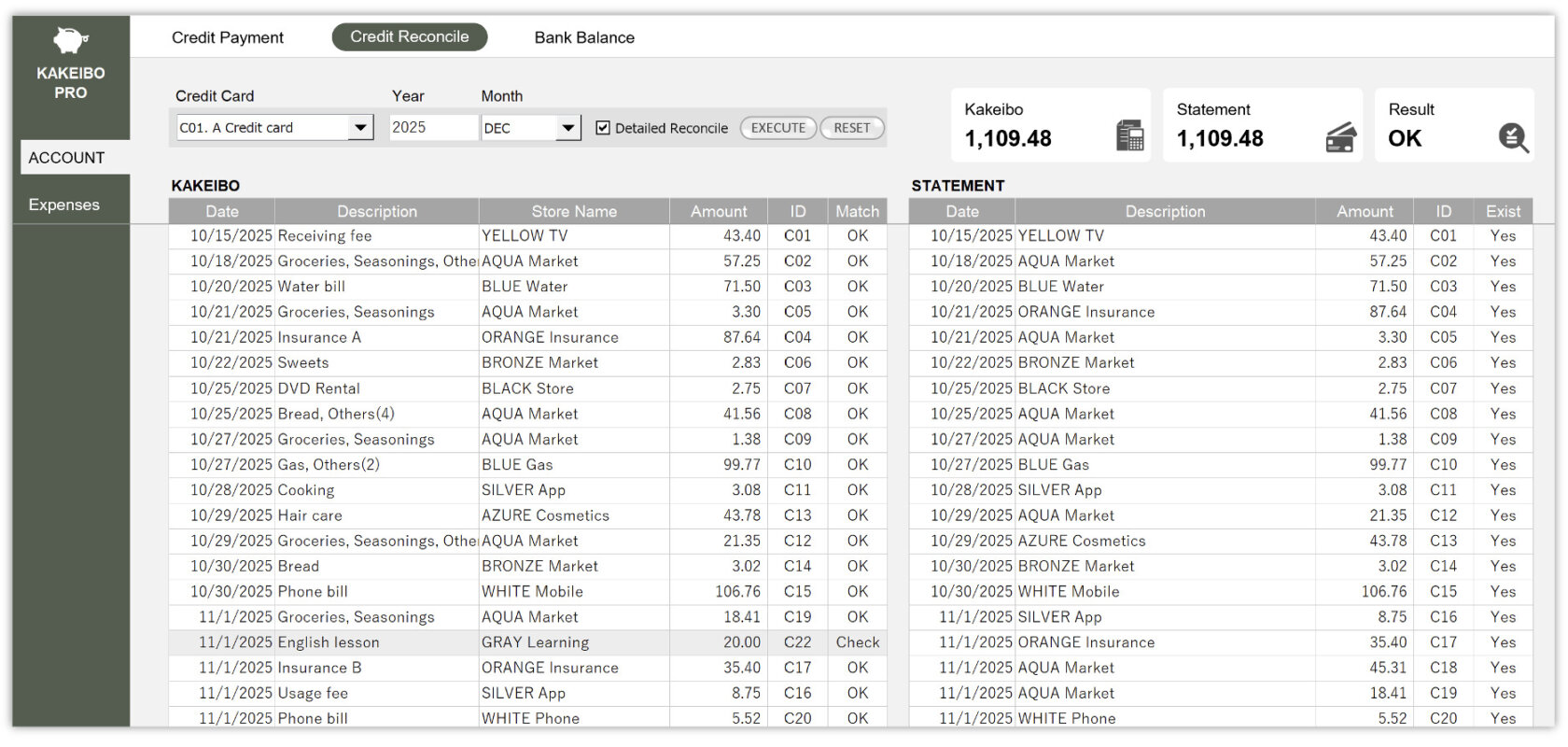

Account Management (PRO only)

If you frequently use credit cards, the account management function is invaluable. By reconciling credit card transactions, you can monitor spending and prevent fraudulent use.

- Credit Card Transaction Reconciliation: Match the billed amount from your credit card company with transaction data in KAKEIBO. It also reconciles each transaction in KAKEIBO with the statement issued by the credit card company.

- Summary of Deposits and Withdrawals: Display a list of deposits and withdrawals from bank accounts.

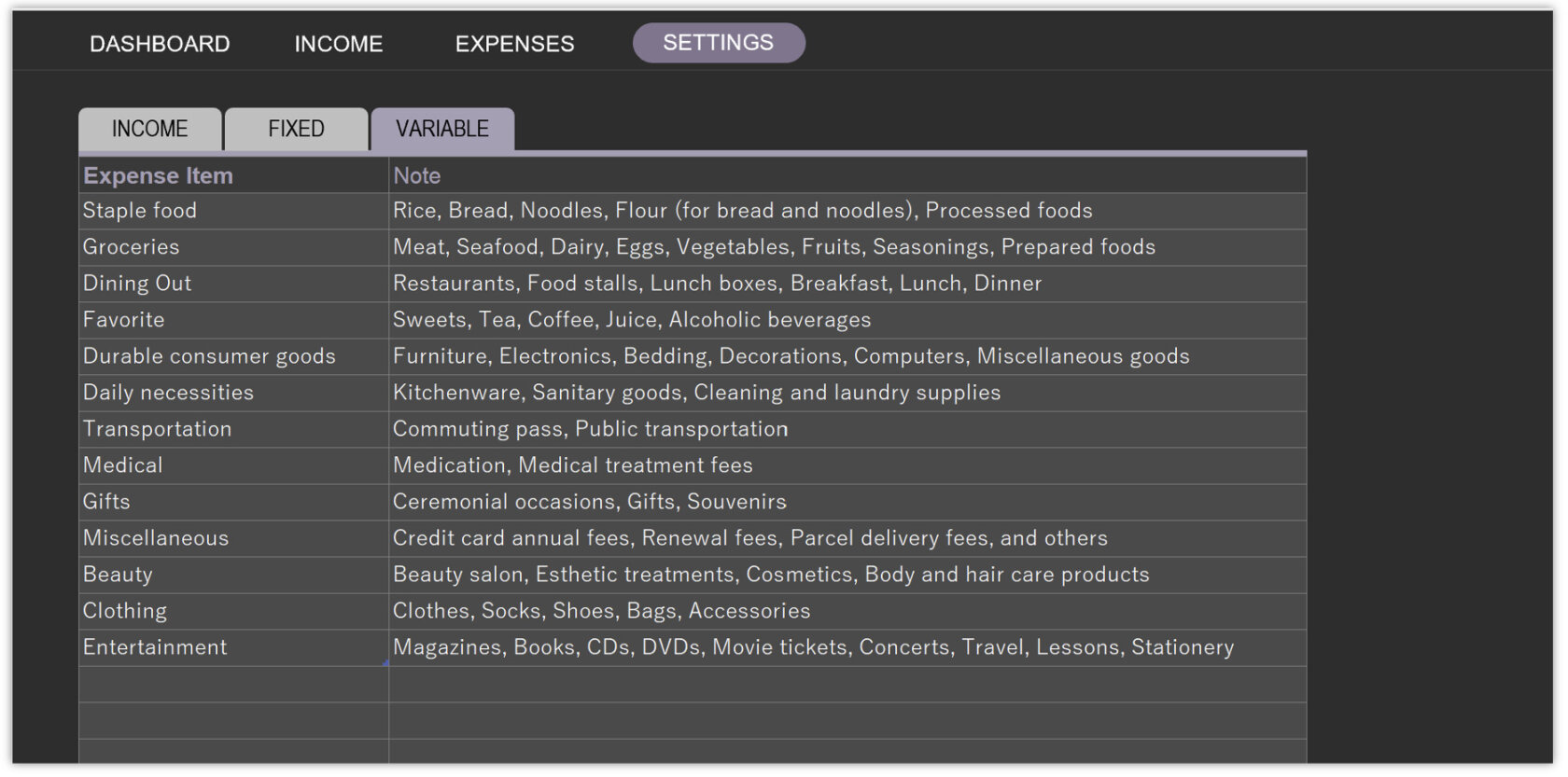

Settings

The settings function allows you to configure essential household budgeting details, such as expense categories.

Additionally, you can access the following customization options:

- Tool Color Settings: Customize the main and sub-colors of the interface.

- Add Data Rows: Insert additional rows into the income and expenditure input sheet.

- Add Columns: Expand the input sheet by adding new columns.

- Set and Unset Sheet Protection: Enable or disable sheet protection as needed.

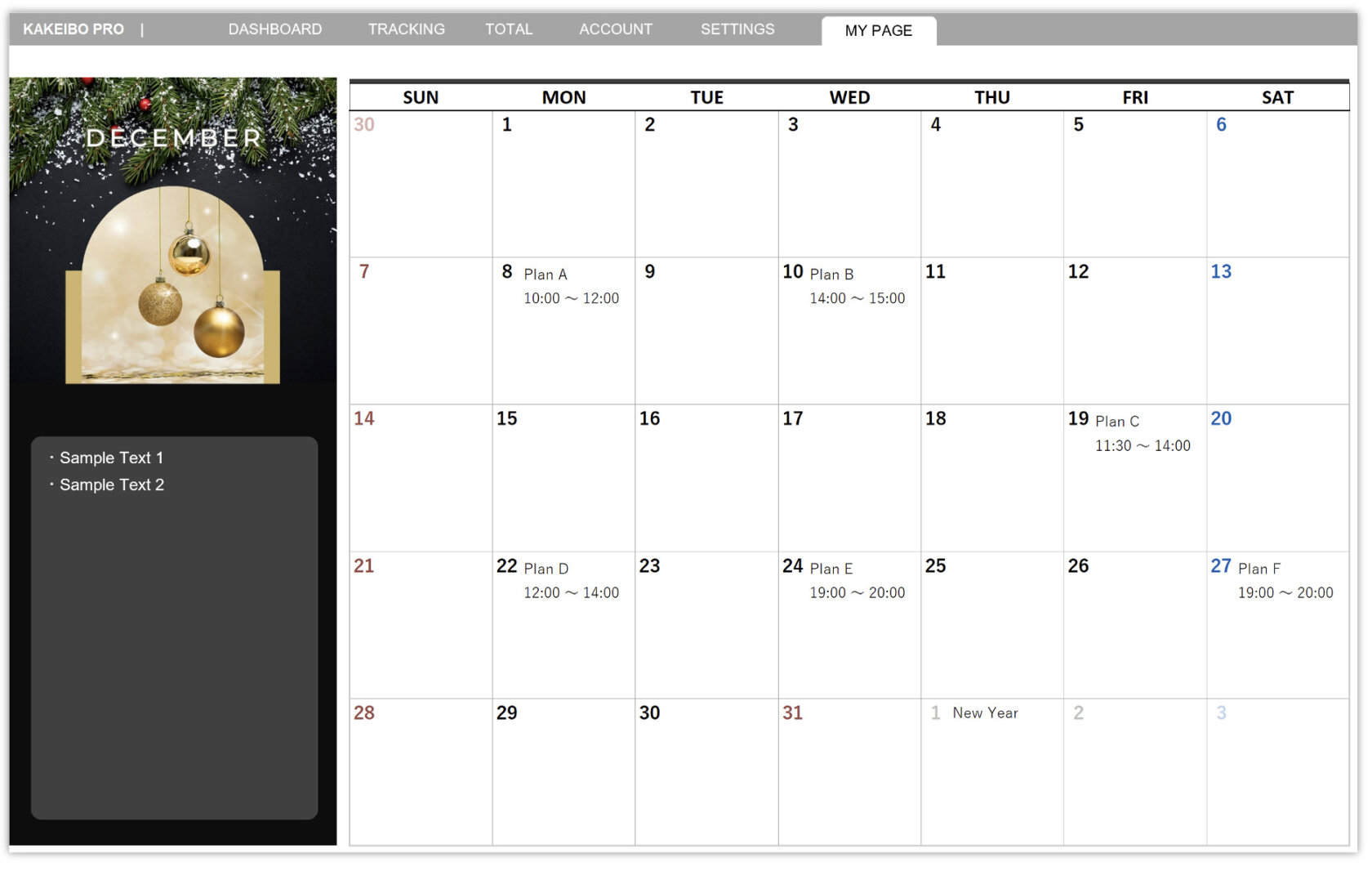

My Page

Create a personalized space with My Page. Here, you can freely customize by adding memos, inserting images, and generating graphs. For example, you can create a calendar to record expenses and events, making it a useful schedule management tool.

2-3 Detailed Features of KAKEIBO SLiM

KAKEIBO SLiM is a household budgeting tool designed with simplicity in mind. It omits complex functions and can be used with just basic Excel operations.

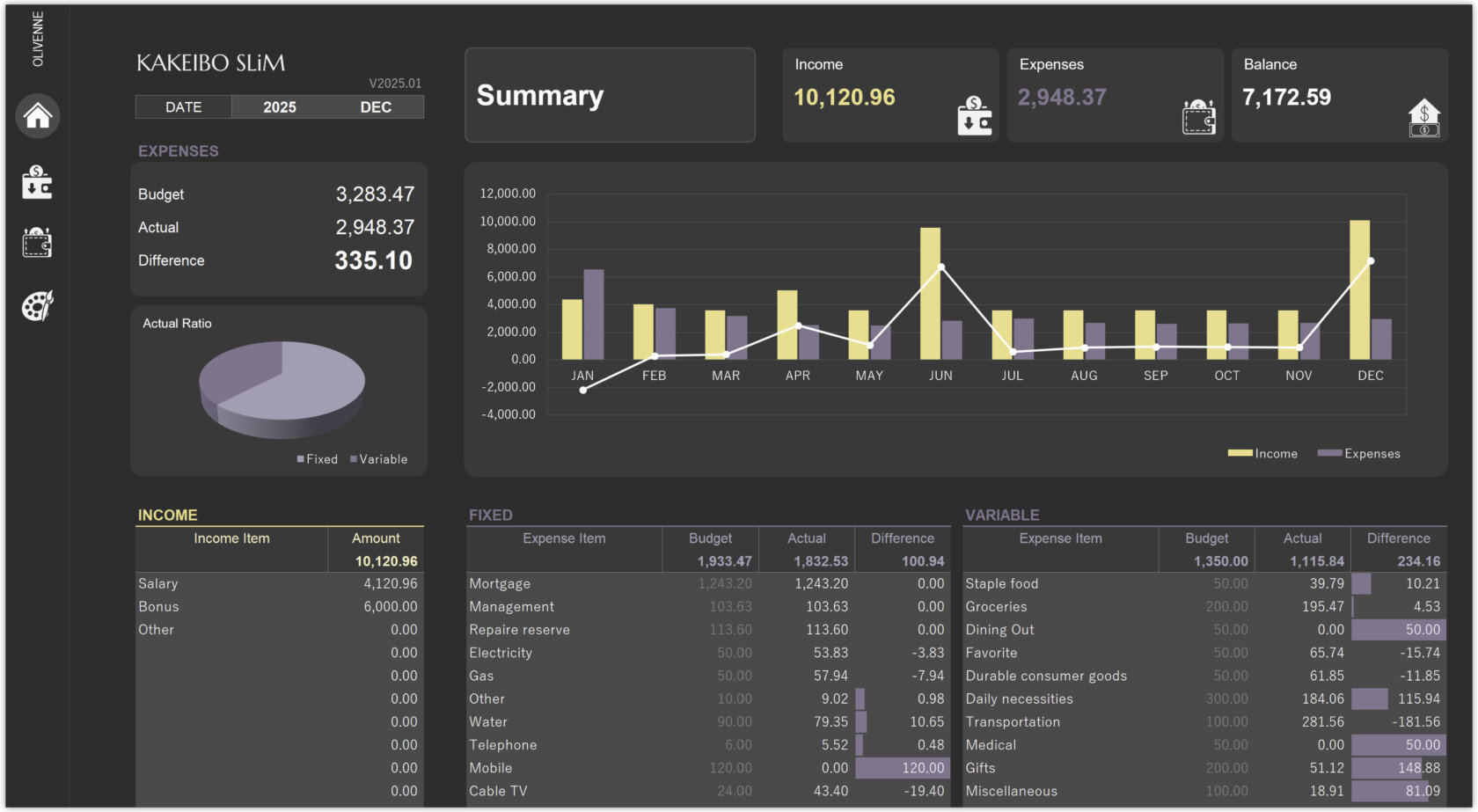

Dashboard

Even with KAKEIBO SLiM, you can get a clear overview of your household finances using the dashboard. Income, expenses, and balances are displayed as tables and graphs on a monthly and annual basis. Compared to KAKEIBO PRO and LiGHT, its features are more limited, but it provides all the essential information. The graphs are simple and easy to read, making them beginner friendly.

- Specify Year and Month: Choose any year and month to display aggregated values.

- Budget vs. Actual Expenses: Compare your set budget with actual expenses.

- Fixed vs. Variable: View the ratio of fixed to variable costs in a pie chart.

- Monthly Total of Income: Check the breakdown of income by item.

- Monthly Total of Expenses and Budget Management: Analyze expense breakdowns by item and compare them to your budget.

- Summary: Displays income, expenses, and balance in a large, easy-to-read font.

- Tracking Trends: Monitor annual income and expense trends with a graph.

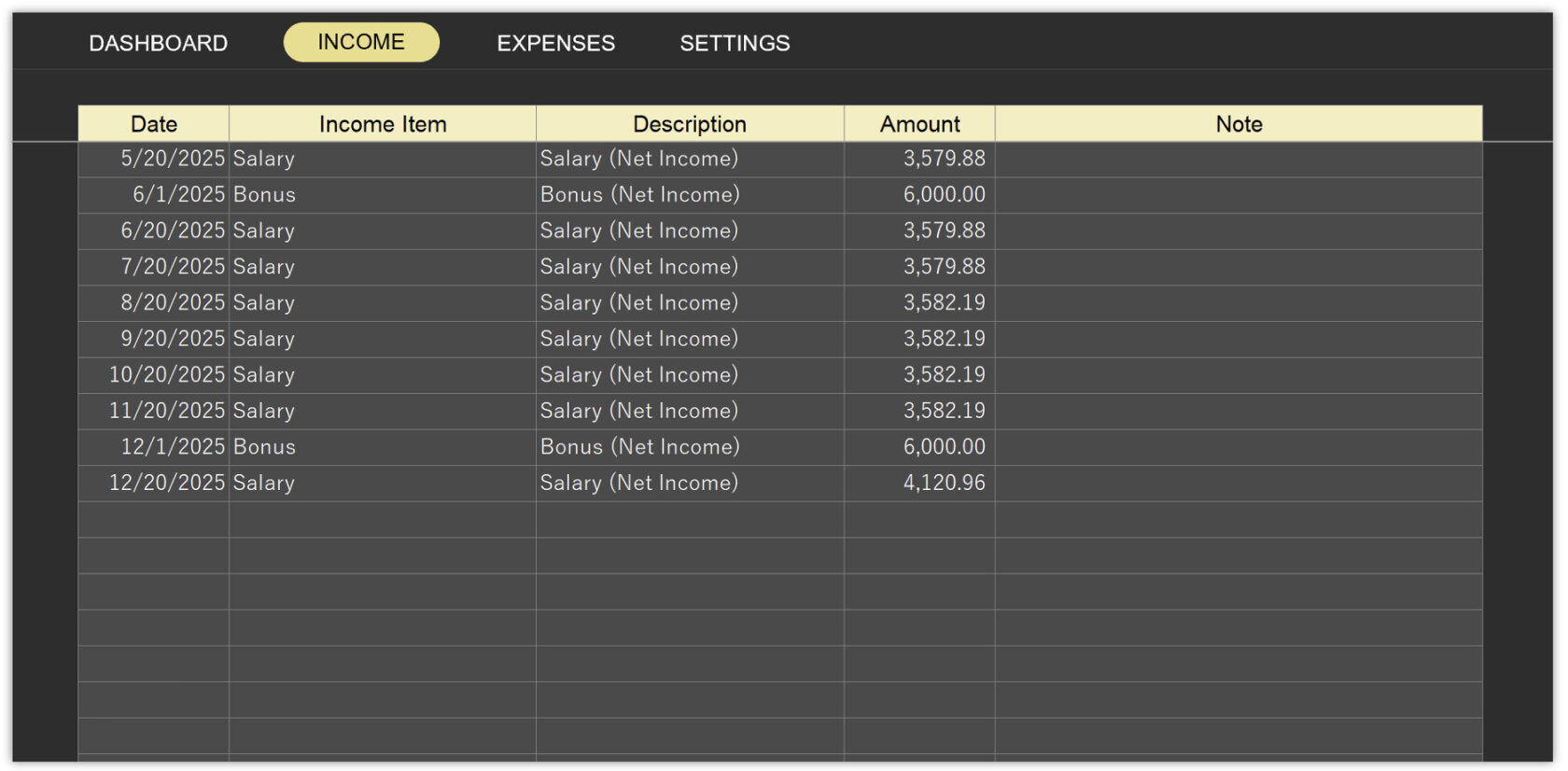

Income/Expense Input

Entering income and expenses in KAKEIBO SLiM is straightforward. Simply enter the date, expense category, amount, and other details in the two dedicated sheets for income and expenses. Since macros are not used, data additions and corrections must be done manually. For those who prefer a fast and simple data entry process, KAKEIBO SLiM is the ideal choice.

Settings

The settings in KAKEIBO SLiM are designed to be as simple as possible. You can configure income categories, fixed expense items, and variable expense items. Setting these categories ensures more accurate data aggregation on the dashboard. With no complicated settings, KAKEIBO SLiM is easy to use — even for those with basic Excel skills.

- Income Items: Define types of income, such as salary, part-time job earnings, and side income.

- Fixed Expense Items: Set recurring monthly expenses, such as rent, utilities, and communication costs.

- Variable Expense Items: Configure expenses that fluctuate each month, such as groceries, transportation, and entertainment.

3. Comparison of the KAKEIBO Series

Not sure which one to choose? I’ll help you decide! This guide compares the three KAKEIBO series from various perspectives, including functionality and device compatibility, so you can find the best fit for your needs.

3-1 Functional Aspects

Wondering which KAKEIBO series — PRO, LiGHT, or SLiM — is right for you? Here, I provide a detailed comparison of the three versions based on their features and capabilities.

| PRO | LiGHT | SLiM | ||

|---|---|---|---|---|

| Dashboard | Summary | 〇 | 〇 | 〇 |

| Budgeting | 〇 | 〇 | 〇 | |

| Monthly Total Table | 〇 | 〇 | 〇 | |

| Annual Total Table | 〇 | 〇 | ✕ | |

| Annual Graphs | 〇 | 〇 | 〇 | |

| Tacking | Income | 〇 | 〇 | 〇 |

| Expenses | 〇 | 〇 | 〇 | |

| Special | 〇 | 〇 | ✕ | |

| Unaccounted | 〇 | 〇 | ✕ | |

| Total & Analysis | Budgeting | 〇 | 〇 | 〇 |

| Compare | 〇 | 〇 | ✕ | |

| Trend Analysis | 〇 | 〇 | ✕ | |

| Account Management | Credit Payment | 〇 | ✕ | ✕ |

| Credit Reconcile | 〇 | ✕ | ✕ | |

| Bank Balance | 〇 | ✕ | ✕ | |

| Settings ※ | Bank Accounts | 〇 | 〇 | ✕ |

| Credit Cards | 〇 | 〇 | ✕ | |

| Income Items | 〇 | 〇 | 〇 | |

| Categories | 〇 | 〇 | ✕ | |

| Expense Items | 〇 | 〇 | 〇 | |

| Regular Spending | 〇 | 〇 | ✕ | |

| Advanced | 〇 | 〇 | ✕ | |

| My Page | 〇 | 〇 | ✕ | |

※PRO and LiGHT allow you to enter up to 30 items per list. SLiM allows you to enter 20 items by default, but you can add more if needed.

3-2 Supported Devices and OS

The KAKEIBO series is compatible with different devices and operating systems. The mobile version of Excel does not support macro functions.

- SLiM (no macros) works on any device.

- PRO and LiGHT (with macros) are designed for computers.

Additionally, the account management function in PRO uses ActiveX Data Objects (ADO)※, which is not supported on Mac OS. As a result, KAKEIBO PRO is not compatible with Mac OS.

※What is ActiveX Data Objects (ADO)? ADO is a system that allows computer programs to interact with databases.

| PRO | LiGHT | SLiM | ||

|---|---|---|---|---|

| Device | Computer | 〇 | 〇 | 〇 |

| Tablet | ✕ | ✕ | 〇 | |

| Smartphone | ✕ | ✕ | 〇 | |

| OS | Windows | 〇 | 〇 | 〇 |

| Mac OS | ✕ | 〇 | 〇 | |

4. Purchasing the Product

The KAKEIBO series is available for purchase from online shops. The Japanese version is sold on BASE, while the English version is available on Etsy. Once your purchase is complete, you will be able to download the file immediately.

KAKEIBO English version

5. User Support

Please refer to the links below to get started with these tools.

If you have any questions or issues while using KAKEIBO, feel free to contact me using the form below.

6. Conclusion

The KAKEIBO series is a powerful tool that makes household budgeting more enjoyable and more effective. In this article, I have provided a detailed explanation of its features, functions, and how to choose the right version for you. Did you find the perfect KAKEIBO for your needs?

KAKEIBO PRO is perfect for thorough and detailed management.

KAKEIBO LiGHT is great for those who want a more casual start.

KAKEIBO SLiM is ideal for simple and straightforward budgeting.

–

No matter which KAKEIBO you choose, your approach to household budgeting will surely change for the better. Make full use of the KAKEIBO series to eliminate financial worries and build a secure future. Household budgeting is an investment in your future. Let’s start today and design a better future together with KAKEIBO!