“I keep a household budget every month, but somehow my wallet always feels light by the end…” Does that sound familiar? Or maybe you’ve thought, “Alright, I’m going to start budgeting this month!”—only to find yourself stuck thinking:

What should I even budget for, and how much?

Constantly cutting back doesn’t seem sustainable…

If that resonates with you, you’re not alone. Even if you diligently record your expenses in a household account book, it can be surprisingly hard to know how to use those numbers to build an effective budget. Simply tracking income and expenses isn’t enough to improve your household finances.

In this article, I’ll answer those questions and clearly explain the secrets to setting an effective budget—one that you can stick with comfortably and that leads to real financial progress.

Language: English Japanese

1. Why Is Budget Setting Necessary?

Simply keeping a household account book helps you understand the flow of money—but that alone isn’t enough to truly improve your finances or achieve your dreams and goals. What’s really essential is budget setting.

In this chapter, we’ll explore the specific reasons why setting a budget can serve as a compass for your financial management. By highlighting both the benefits of having a budget and the drawbacks of not setting one, you’ll see why taking that first step toward budget planning is so important.

1-1. The Purpose and Benefits of Budget Setting

I know how much I spend on everything each month—isn’t that enough?

Some of you might be thinking that. And yes, recording your income and expenses is the foundation of good household financial management—it’s an important first step. However, if you want to make the most of those records and take a more active role in controlling your cash flow, budget setting is essential.

Preventing Wasteful Spending

The primary purpose of budget setting is to provide clear guidelines for how you use your money and to encourage intentional, planned spending. This directly leads to one major benefit: preventing wasteful spending. For example, if you set a rule like, “This month’s entertainment budget is ¥XXX,” it becomes much easier to rein in impulsive purchases, doesn’t it?

Realizing Your Goals

Furthermore, budget setting also supports more positive objectives—such as saving for the future or achieving specific goals like traveling, making large purchases, or obtaining certifications. By working backward from your target amount and desired timeframe, and incorporating those figures into your monthly budget, you’ll begin to feel your dreams becoming much more attainable.

Mental Stability

When you decide in advance how much to spend on each category each month, you free yourself from the vague anxiety of questions like, “How much more can I spend this month?” Reducing that uncertainty can significantly contribute to your peace of mind.

POINT

Budgeting also allows you to compare your planned spending with your actual expenses. This brings valuable insights—such as realizing, “My food expenses are higher than I thought,” or “Maybe I can cut back on this fixed cost.”

In other words, budget setting isn’t just about understanding your current financial situation—it’s a concrete action plan that brings you closer to your ideal financial future.

1-2. The Disadvantages of Not Setting a Budget

What happens if you don’t decide in advance how much to spend in each category each month—in other words, if you don’t have a budget? Let’s take a look at some of the specific drawbacks that can arise.

Vague Anxiety

One of the first drawbacks is the constant, vague anxiety of wondering, “How much more can I afford to spend this month?” For instance, when a friend invites you out for a meal, you might not be able to fully enjoy it because you’re thinking, “I want to go, but can I really afford it?”

Or when you see something you want to buy, you might hesitate, asking yourself, “Is it okay to spend on this right now?” When money concerns are always lingering in the back of your mind, it becomes hard to fully enjoy even the small pleasures of everyday life.

Tendency to Overspend

Another major drawback is the increased risk of unknowingly overspending. Have you ever had a month where small indulgences—“I splurged a little, but it’s fine”—start to add up, and by the end of the month, you’re suddenly panicking: “Wait… I have way less money left than I thought!”

This is especially common with credit card or electronic payments, where the feeling of spending is less immediate. Without the conscious control that a budget provides, it’s all too easy to lose track and overspend.

Difficulty Achieving Goals

This all leads to a major problem:the inability to save systematically. Even if you think, “I’ll just save whatever’s left over,” money rarely accumulates without clear targets or monthly savings goals.

You might have dreams like “I want to travel abroad someday” or “I want to save as much as I can for the future,” but without a plan, it’s easy to get swept up in everyday expenses—and those goals can start to feel more and more out of reach.

POINT

In short, if you don’t decide how much to spend on each category every month, it can lead to several disadvantages—such as a lack of day-to-day financial peace of mind, a tendency to overspend, and difficulty saving for the future.

2. Preparing for Budget Setting

Even if you enthusiastically declare, “Alright, I’m going to set a budget!”—simply jotting down ideal numbers might end up being just a pipe dream. To create an effective and realistic budget, the first essential step is to accurately understand your current financial situation.

In this chapter, we’ll walk through concrete steps to help you assess where you stand financially—forming the solid foundation for successful budget planning.

How much do I want to save for the future?

How much do I actually earn each month?

Where is my money going, and how much am I spending in each category?

Answering these questions will help you craft a more realistic and achievable budget plan. So let’s begin with a financial check-up—your first step toward smarter money management!

2-1. Step1: Accurately Understand Your Net Income

I can see my monthly income on my payslip—but is that enough?

What about bonuses or side job income—how should I factor those in?

You might be asking yourself these questions. The most fundamental aspect of budgeting is to accurately identify the money you can actually use—in other words, your net income or take-home pay. This is the true starting point for building a realistic budget.

Why focus on net income instead of gross income? Because gross income includes mandatory deductions like taxes (income tax, resident tax) and social insurance premiums (such as pension and health insurance). These are payments you can’t avoid.

The money you can actually use for daily living, saving, and spending is your net income—the amount left after these deductions. To find this, check your payslip for items labeled “Net payment amount” or “Transfer amount.”

If Your Income Varies by Month

Budgeting is relatively straightforward for those with a steady monthly salary. However, if your income fluctuates—due to overtime, freelancing, part-time work, or gig jobs—it can be more challenging. In such cases, it’s important to budget conservatively. You can do this by:

- Using the month with the lowest income as your baseline

- Calculating the average monthly income over the past few months (ideally over the past year)

What About Bonuses or Temporary Income?

It’s best to manage bonuses or other temporary income separately from your regular monthly budget. Rather than relying on them for everyday expenses, plan to use these funds for large, planned purchases or special savings goals.

POINT

The key to a solid budget plan is to first have a clear understanding of the amount you can reliably use each month—your consistent, dependable income.

2-2. Step2: List Out Your Expenses

I feel like my money keeps disappearing, but I don’t really know where it’s going…

Many people find themselves in this exact situation. Once you’ve figured out your income, the next important step is to visualize your expenses. Without a clear understanding of what you’re spending money on—and how much—you won’t be able to identify areas to cut back or know which expenses should be prioritized.

To make this process easier, start by dividing your expenses into two categories: fixed costs and variable costs. The following article explains each of these in detail.

Begin by carefully reviewing and listing your expenses from the past one to three months. You may be surprised by what you discover—“I didn’t realize I was spending this much on that!” It might take a bit of effort, but this step is essential for creating an effective, realistic budget.

2-3. Step3: Decide on Your Savings and Investment Goals

I want to save at least a little every month—but how much should I actually aim for? I’d like to start investing for the future, but how do I set realistic goals?

Once you’ve understood your income and expenses, the next step is to set specific savings and investment goals. Simply thinking, “I want to save,” in a vague way often doesn’t lead to action and makes it hard to stay motivated. When setting goals, start by clearly identifying the purpose, the timeframe, and the amount you want to save. For example:

- Save ¥500,000 in 3 years for an overseas trip.

- Save ¥5,000,000 in 10 years for a home down payment.

- Invest ¥30,000 monthly toward retirement.

The more specific your goals are, the easier it becomes to determine how much to include in your monthly budget—and the path to achieving them becomes clearer.

Once you’ve set a target amount and deadline, calculate the monthly savings or investment amount needed to reach it. The key here is to avoid setting overly ambitious goals. Make sure your targets are realistic and sustainable based on your current income and expenses.

You might start small and gradually increase your targets as you gain confidence and see progress. Also, keep in mind that your savings needs will likely evolve with major life events—such as marriage, having children, or funding education—so it’s important to review and adjust your goals regularly.

POINT

Having clear, purpose-driven goals adds meaning to your day-to-day budgeting and helps you stay motivated and proactive.

3. Practice! How to Create a Sustainable Budget

I’ve figured out my income and expenses—but how exactly should I allocate my budget?

What’s a reasonable amount to spend on food or entertainment?

If questions like these are starting to come up, you’re right on track. Now that you’ve grasped your current financial situation, it’s time to move on to the full-fledged budget-setting phase.

In this chapter, I’ll explain basic budget allocation methods and tips for setting specific itemized budgets, so that the budget you’ve worked hard to create doesn’t become a short-lived effort. I would like to help you build a sustainable budget—one that you can stick to without unnecessary strain—by finding the right balance between your ideals and your reality.

3-1. Basic Budget Allocation Methods

From my net income, what should I prioritize—and in what proportions? Is there a guideline I can follow?

Absolutely. When it comes time to actually create your budget, it’s easy to feel overwhelmed. That’s where basic budget allocation methods come in handy—they provide a helpful starting point and framework.

One widely recommended approach is the formula:

Income – Savings = Spendable Amount

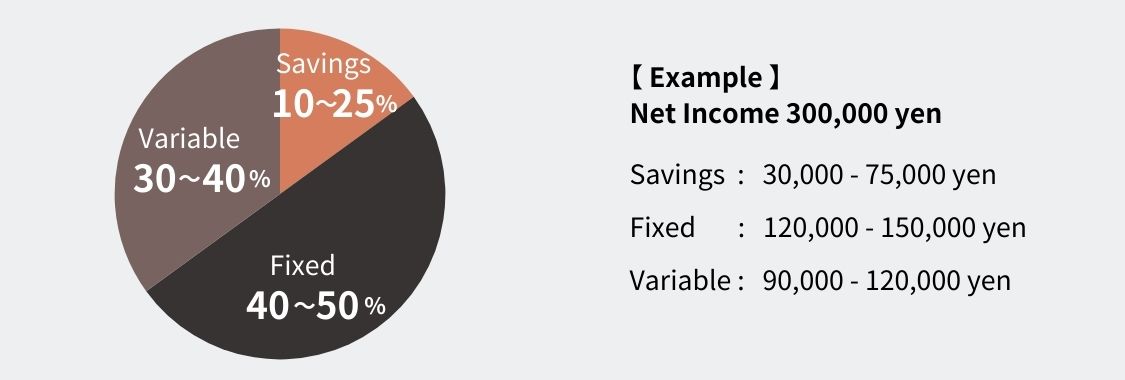

This reflects the “pay yourself first” concept. Instead of saving whatever’s left at the end of the month, you set aside your savings first—then live on what remains. As a general guideline, here’s a commonly suggested breakdown based on net income:

This is just a general guideline, and the optimal balance will vary depending on your family structure, lifestyle, and location. It’s important to adjust it to suit your personal circumstances. For example, “In my case, rent is high, so fixed expenses take up a larger portion,” or “I have education costs for my children, so I need to review my variable expenses.”

Start by using this basic concept and the suggested percentages as a reference, and try simulating them with your own household finances.

3-2. Setting Budgets for Each Expense Item

I understand the overall budget breakdown, but how do I decide how much to spend on things like food or hobbies? I’m worried that if I make it too strict, I won’t stick with it…

It’s completely normal to feel this kind of uncertainty. Once your overall budget framework is in place, the next step is to set specific amounts for each expense category. The key here is to strike a balance—don’t ignore your current spending habits, but aim to tighten things up just a little.

Start by looking at your actual spending from the past few months (as gathered in the earlier step). For example, if your average food expense over the past three months was ¥50,000, it might not be realistic to suddenly slash it to ¥30,000. Instead, try setting a slightly lower target—say, ¥45,000. Once you successfully stick to that, you can gradually adjust toward your ideal.

For expenses that are important to your well-being or happiness—like quality food, fitness activities, or a favorite hobby—don’t cut them unreasonably. Instead, look for other areas where you might be able to make small compromises.

Another important tip: don’t overcomplicate your categories. For example, instead of separately tracking Snacks, Drinks, and Lunches, it’s often easier and more flexible to group them under a broader category like Food.

POINT

Remember, the goal isn’t perfection. It’s to build a budget that’s practical, comfortable, and effective for you. Through a bit of trial and error, you’ll find the approach that suits your lifestyle best.

4. Conclusion

So far, we have discussed effective budget setting in household accounting. By simply adding the extra step of budget setting to your daily record-keeping, you can clarify your cash flow, prevent wasteful spending, and move closer to achieving your future dreams and goals.

It might feel a bit troublesome at first, but once you establish a budgeting style that suits your household, all that remains is to make it a habit and review it regularly. It’s important not to aim for perfection, but to take the first step within a range that feels comfortable for you.

Additionally, the Excel household budget tools I created—KAKEIBO PRO, LiGHT, and SLiM—are equipped with convenient budget management features. By using these tools, you can eliminate complex calculations and effort, making it much easier to put effective budget management into practice. I encourage you to try them out and find the method that works best for you.

I hope this article helps you improve your household finances and achieve financial peace of mind. Why not start effective budget setting today?