“This is the year I’ll finally manage my finances properly!” Have you ever started keeping a household budget with great enthusiasm, only to find yourself wondering, “Why am I in the red every month?” or “I can never stick to my budget!”? You set a budget, but before you know it, your plans have fallen apart. This might be an experience you’ve had more than once.

Why does my budgeting never work out?

Isn’t there a smarter, less stressful way to manage money?

Actually, there are several common pitfalls that cause people to struggle with budgeting. But by learning just a few simple tips, budgeting—which may have always felt difficult—can start going surprisingly smoothly.

In this article, I’ll clearly explain practical strategies to help you avoid common budgeting failures and support your journey toward better household finances.

Language: English Japanese

1. Tips to Avoid Failure in Budget Setting

You might start off thinking, “Alright, this budget is perfect!”—but once you try to put it into practice, you may find yourself wondering, “Wait… why isn’t this working?” That’s completely normal. Budgeting isn’t a one-and-done task—it’s an ongoing process. What really matters is not just setting a budget, but being able to keep it going over time.

How can I stick with it without burning out?

What should I do when my circumstances change?

What if I mess up and go over budget in a month?

While addressing these questions, I’ll share tips for more flexible and realistic budget management. In this chapter, I’ll introduce practical strategies to prevent the budget you’ve carefully created from becoming a mere pipe dream—and to help you maintain it without unnecessary stress.

1-1. Aim for a Reasonable Budget

Should I be as strict as possible to save more?

But if I cut too much, I’m afraid I won’t be able to stick with it…

These are common concerns—and for good reason. One of the most important principles in budget setting is to aim for a realistic and sustainable plan.

Overly strict budgets may look good on paper, but in reality, they often lead to stress and burnout. If you drastically cut your food budget or completely eliminate fun and leisure spending, you might find yourself losing joy in daily life. This can lead to what’s called savings fatigue—and may even result in a binge-spending rebound or giving up on budgeting altogether.

The key is to find a balance between your ideal and your current reality. Start by reviewing your past spending and set a budget that feels like, “This seems achievable.” From there, make gradual improvements. Small, manageable goals—like “Let’s reduce food costs by 5% this month,” or “I’ll cut 1,000 yen from entertainment compared to last month”—can create a sense of progress and boost motivation.

Also, consider building in buffers like a “contingency fund” for unexpected expenses or a “reward fund” for treating yourself. These give you flexibility and help you maintain peace of mind while staying on track. In short, a budget that you can enjoy sticking with—without unnecessary pressure—is the first and most important step to long-term success.

1-2. Review Your Budget Regularly

Can I just stick with the budget I created forever?

Should I change my budget if my lifestyle changes?

It’s natural to have such questions. A budget isn’t something you create once and forget; it’s important to review it regularly and update it to reflect your current circumstances.

Life is constantly changing—your income may rise or fall due to promotions, job changes, or shifts in employment. Major life events such as marriage, childbirth, children starting school, or moving can significantly affect how you spend and how much you need. Additionally, changes in prices or the broader economic environment can impact your household finances. For instance, a food budget that worked a few years ago might no longer be realistic due to recent price increases.

That’s why it’s a good idea to review your budget at least once every six months—or better yet, every three months. When you review your budget, ask yourself:

- Am I still comfortable living within this budget?

- Are there any areas where I can spend more efficiently?

- Do I need to increase my savings for a new goal?

Compare your current spending with your budgeted amounts. If you notice big differences, adjust accordingly. And whenever a major life event happens, make reviewing your budget part of your adjustment process. Regular reviews help ensure your budget remains realistic, relevant, and effective—so it continues to support your goals instead of becoming just another forgotten plan.

1-3. Think of the Budget Flexibly as a Guideline

I made a budget, but this month an unexpected expense came up and I went way over… What’s the point?

It’s easy to feel discouraged when things don’t go according to plan—but don’t be too hard on yourself. One of the most important mindset shifts for long-term success is this: a budget is not a strict rulebook—it’s a flexible guideline.

Unexpected expenses are a normal part of life—whether it’s attending a wedding or funeral, dealing with a broken appliance, or covering medical costs due to illness or injury. Things won’t always go according to plan, and that’s okay. Instead of getting discouraged and thinking, “I failed to stick to my budget…” try to shift your mindset and ask, “Why did I go over budget?” and “How can I adjust things in the coming months?”

Even if a single expense exceeds your budget, you can ease the pressure by thinking in terms of balance over the month—or even over several months—by adjusting other categories or offsetting it with the next month’s budget. The goal isn’t to stay perfectly within budget every single month. What truly matters is becoming more mindful of your spending, cutting down on waste, and gaining greater control over your finances.

Even if you go over budget some months, it’s okay—as long as your overall household finances are improving over time. Don’t aim for perfection. Instead, take a relaxed and realistic approach, reminding yourself: “The budget is an ideal plan—real life requires flexibility.”

2. What If You Go Over Budget?

“Oh no, I’ve gone over budget again this month…” It’s disheartening when things don’t go according to plan, isn’t it? You might find yourself feeling frustrated, blaming yourself, or even thinking about giving up on budgeting altogether. But don’t worry—going over budget can actually be a valuable opportunity to review and improve your financial habits.

In this chapter, I’ll walk you through exactly what to do when you can’t stick to your budget, and the kind of mindset that will help you stay motivated and move forward with confidence.

Why did I go over budget?

How should I adjust for next month?

Maybe budgeting just isn’t for me…

We’ll tackle these common concerns and help you find your next steps. With the right approach, you can overcome budgeting challenges wisely—without fearing failure.

2-1. Analyze the Cause

I went over budget—but what exactly caused it?

Is it enough to just say I overspent and move on?

When you can’t stick to the budget you’ve set, the first important step is to calmly analyze why you went over. Simply feeling discouraged and thinking, “I failed again…” can lead to repeating the same mistakes. Take a close look at your household budget or expense tracker. Which category went over? Was it food? Entertainment? Or perhaps an unexpected large expense?

You might find clear reasons such as:

“I ate out a lot this month.”

“I impulsively bought too much during a sale.”

“There were several ceremonial events like weddings or funerals.”

–

The steps you take next will depend on whether the cause was a one-time event or something that happens regularly. The key to improvement is starting with a clear, objective understanding of your spending habits.

2-2. Adjust Next Month’s Budget

How should I adjust next month’s budget to account for this month’s overspending? Is there a way to recover without making things too difficult?

Once you’ve identified the cause of the overspending, the next step is to take concrete action. Think about how you can adjust next month’s budget to absorb the extra spending—but do it within a realistic and manageable range.

For example, if you overspent by 5,000 yen this month, it might not be practical to simply cut 5,000 yen from next month’s food budget. Sudden, drastic changes are hard to maintain and often lead to more frustration. Instead, review which spending categories can be adjusted. It’s usually easiest to start with variable expenses, like entertainment or dining out.

Try small, achievable changes like:

“Maybe I’ll eat out one less time next month.”

“I’ll try to scale back a bit on hobby-related spending.”

–

If the overspending was due to a one-time large expense—like medical bills—it can be smarter to spread the recovery over a few months, rather than trying to fix everything at once. The most important thing is not to get discouraged by a single setback. Budgeting is a process of trial and error, and flexible course corrections are part of what make it sustainable.

2-3. Consider Fundamental Countermeasures

I keep going over budget on the same expenses every month. What should I do? Could it be that my current budget is unrealistic?

If the same expense category consistently exceeds your budget month after month—or if adjustments never seem to work—it may be time to consider more fundamental changes. The issue might not be temporary overspending, but rather deeper problems with how your budget is set or aspects of your lifestyle.

For example, if you’re always going over on food expenses, take a step back and evaluate whether the amount you’ve budgeted is too low for your current lifestyle or family size. On the other hand, it may be a matter of changing daily habits—like cooking at home more often, buying in bulk, or taking advantage of discounts and sales.

If fixed costs such as communication fees or insurance premiums seem high, consider reviewing your plans or switching providers to reduce those expenses. And if you tend to make impulse purchases, work on developing mindfulness around spending—pause before buying and ask yourself, “Do I really need this?” The key is to look honestly at your current situation and develop long-term strategies for improvement.

2-4. The Important Thing Is Not to Dwell on It

I get really down when I go over budget…

How can I shake off this frustration?

It’s completely normal to feel disappointed or blame yourself when you go over budget. Thoughts like, “Maybe I’m just not good at managing money,” can creep in easily. But the most important thing is not to dwell on the setback.

Managing household finances isn’t a test where you’re aiming for a perfect score. It’s more like a long-term journey—one where you learn through trial and error what works best for you. Everyone goes over budget now and then. What matters is turning that experience into insight. If you can think, “That approach didn’t work this time—let’s try something different next month,” then it’s not a failure; it’s progress.

Striving for perfection often adds unnecessary pressure and makes budgeting harder to stick with. Sometimes, it’s okay to take a step back and say, “Well, this month was a bit off—next time will be better.” The key is persistence. Stay consistent, be kind to yourself, and keep moving forward—one small step at a time—toward the household finances you want to build.

3. Budget Management Using Tools

I try to keep a household budget, but I just can’t keep up with managing it…

Isn’t there a more efficient way to handle my finances?

If you’ve ever had these thoughts, you’re not alone. Handwritten household account books and budgeting apps can be helpful, but sometimes they don’t quite match your style or needs. The good news is—there might be tools out there that fit you better.

In this chapter, I’ll introduce three Excel-based household budgeting tools I developed: KAKEIBO PRO, LiGHT, and SLiM. I’ll explain exactly how each tool works and how they can support your budget management in practical ways.

Which tool is best for me?

Aren’t Excel budgets hard to use?

I’ll answer these common questions and share tips to help make budgeting not only easier—but also more enjoyable. With the right tool, smart financial management is well within your reach. Let’s work toward your ideal budget using tools that truly support your lifestyle.

3-1. Using KAKEIBO PRO / LiGHT

How exactly can KAKEIBO PRO and LiGHT help with budget management?

What does it mean to group expense items?

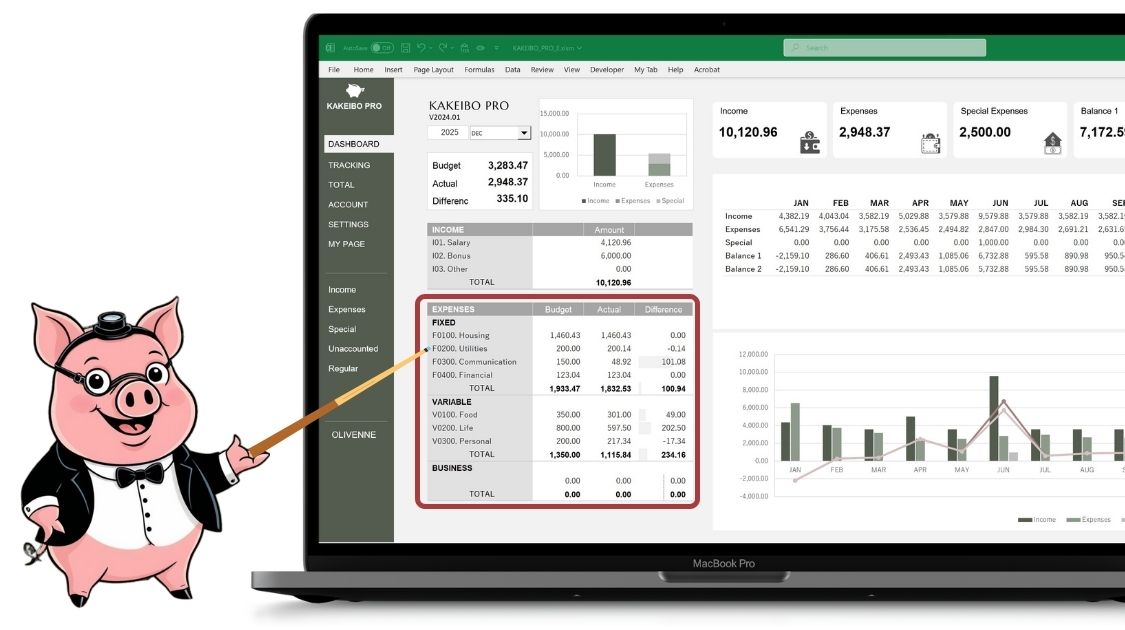

One of the key features of KAKEIBO PRO and LiGHT is the ability to record your daily expenses by individual expense items—such as food, daily necessities, and hobbies/entertainment—and then group them into broader categories, like Living Expenses, Fixed Costs, or Self-Investment.

You might be wondering: “What’s the benefit of setting a budget by category?”

The answer is perspective. Rather than getting caught up in every tiny spending detail, you can step back and ask bigger-picture questions like, “Am I within budget for overall living expenses this month?” This makes it easier to manage your finances without unnecessary stress or micromanagement.

Another helpful feature is the dashboard, which allows you to instantly compare your budget and actual spending for each category. This makes reflection simple:“Hmm, I went over a bit in the ‘Entertainment’ category this month. I’ll dial it back next month.”

By consistently tracking your daily spending and regularly reviewing the dashboard, you can build healthy budgeting habits—without feeling overwhelmed.

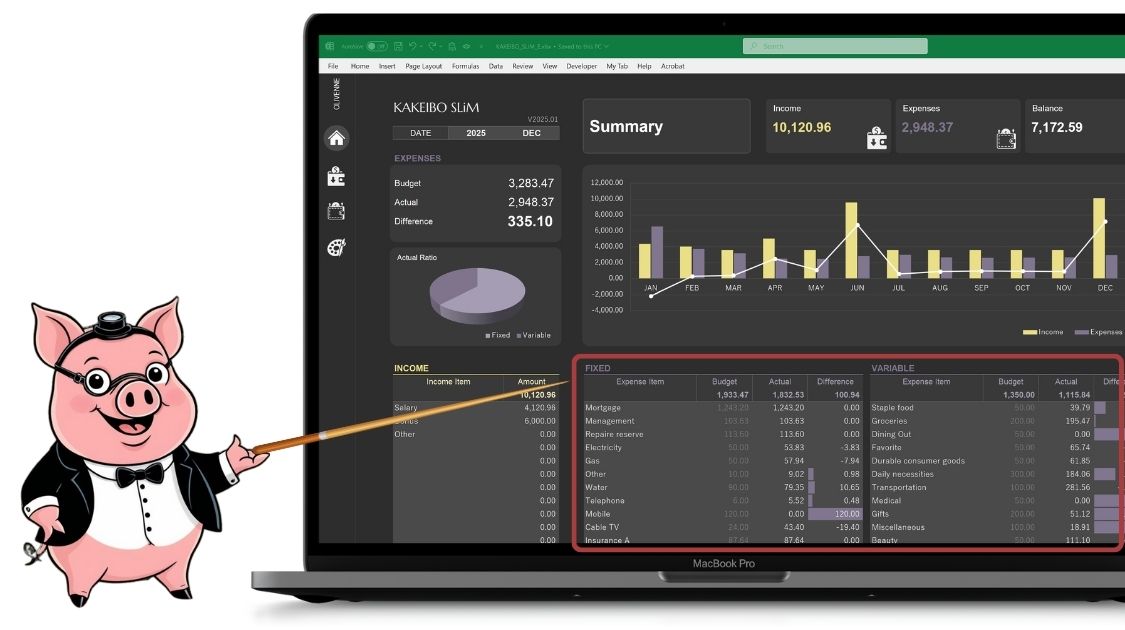

3-2. Using KAKEIBO SLiM

KAKEIBO SLiM seems to set budgets for each expense item. What’s the benefit of managing things in such detail? How is it different from PRO or LiGHT?

Unlike KAKEIBO PRO or LiGHT, KAKEIBO SLiM takes a more detailed approach by allowing you to set budgets and track spending for each individual expense item. For example, under Food Expenses, you can set separate budgets for Dining Out and Groceries.

You might be thinking, “Isn’t setting a budget for every item too much work?” But this method has a big advantage—especially if you want to manage specific spending areas precisely and intentionally.

Say you have a clear goal like: “I really want to keep my dining out expenses under 10,000 yen this month.” With KAKEIBO SLiM, you can set that specific target and easily track your progress day by day. This focused awareness can be a powerful motivator and lead to better spending control.

Like PRO and LiGHT, SLiM features a dashboard that visually compares your budget and actual spending for each item. You can instantly see things like: “How much more can I spend on groceries this month?” This visibility helps prevent overspending and makes adjustments easier in real time.

This tool is especially recommended for those who want to closely monitor specific expenses or start small by managing just a few categories at a time.

4. Conclusion

In this guide, we’ve explored practical steps, mindsets, and tools to help you avoid common pitfalls in household budgeting.

If you’ve ever thought, “I set a budget, but things never go as planned…” — you’re definitely not alone. What matters most is not avoiding failure altogether, but starting anyway, learning as you go, and gradually finding a method that works for you.

By learning how to analyze the causes of overspending, make smart adjustments the following month, and tackle deeper issues when needed, you can approach financial management with more confidence and clarity. And with the KAKEIBO series of Excel-based budgeting tools, you’ll have a reliable partner to make daily budgeting easier, more efficient, and even enjoyable.

You don’t have to get everything right from the start. Take it one step at a time, at your own pace. Small, consistent efforts lead to real results. Let this be the beginning of a richer, more balanced financial life.