“I try my best to keep a household ledger every month, but somehow I’m always just scraping by at the end…” “I made a budget to save money this year, but I always find myself going over…” Does this sound familiar?

The reason your financial management might not be working isn’t necessarily how you’re tracking your expenses, but rather how you’re setting your budget in the first place. When you begin your monthly financial planning, do you have a clear understanding of how much money you truly have for flexible spending?

From rent and utilities to your phone bill and those easy-to-overlook subscription fees, if you first set aside the money you’re guaranteed to spend, budget management becomes surprisingly simple.

In this article, I’ll introduce concrete steps for effective, sustainable budgeting using the Excel household ledger tool, KAKEIBO PRO/LiGHT. It’s time to stop worrying about, “How much do I have left to spend?” Let’s take the first step together toward a manageable budget that suits your lifestyle—and start managing your finances wisely.

Language: English Japanese

1. Why Separate Categories and Items?

One common reason people give up on keeping a household ledger is the challenge of setting up expense items. “If I make it too detailed, tracking becomes a hassle…” “But if it’s too broad, I lose sight of where my money is going…” Have you ever faced this dilemma?

This chapter introduces the fundamental concept behind the Excel ledger KAKEIBO PRO/LiGHT that addresses this very issue. Why does this tool manage expenses using two levels—broad ‘Categories’ and more specific ‘Items’?

This simple yet powerful structure is the key to achieving both sustainability and ease of management. Let’s begin by understanding this core philosophy so you can build a budgeting foundation that’s both practical and easy to maintain.

1-1. A Classification Method to ‘Visualize’ Your Spending

What’s the best way to categorize expenses in a ledger? Should I separate groceries and daily necessities? Is dining out a food expense or an entertainment expense?

When people first start managing their finances, many stumble at this stage of setting rules for classification. Even if you create your own system, you might later hesitate—“Which category does this go in?”—making the task of recording expenses feel burdensome.

KAKEIBO PRO/LiGHT solves this problem with a simple and intuitive classification method. It organizes expenses into two tiers: Expense Categories (Major Classification) and Expense Items (Minor Classification).

- Expense Category (Major Classification):

These are broad groupings that reflect how you use your money—such as ‘Food, ’Living Expenses,’ and ‘Housing.’ You’ll refer to these categories when setting your budget or reviewing your monthly spending. - Expense Item (Minor Classification):

These are specific breakdowns within each category. For example, under the ‘Food’ category, you might have items like ‘Groceries,’ ‘Dining Out,’ and ‘Snacks/Drinks.’ These are selected when recording day-to-day expenses.

By recording in detail but managing from a broader perspective, you can enter daily expenses without hesitation while still gaining a clear, comprehensive view of your finances.

1-2. The Benefits of Two-Tier Classification

But doesn’t separating expenses into two tiers just make things more complicated and add to the workload?

You might think so—but in reality, this two-tier classification is a highly effective way to overcome two of the biggest hurdles in bookkeeping: the hassle of recording and the difficulty of managing. This method offers two major benefits:

Benefit 1: Makes Daily ‘Recording’ Easier

When we record daily expenses, we tend to remember them as specific actions—like “I bought groceries at the supermarket” or “I had lunch at a café.” With a two-tier system, you can intuitively select the appropriate Expense Item, such as ‘Groceries’ or ‘Dining Out,’ without hesitation.

If you only had a broad category like ‘Food,’ you might pause and wonder, “Does today’s lunch count as a food expense or something else?” But by having clearly defined, specific items, the mental load is reduced—making it much easier to keep up with your ledger consistently.

Benefit 2: Makes Monthly ‘Management’ Easier

“When you try to set a budget, doesn’t it feel restrictive to decide on detailed amounts like, ‘¥30,000 for groceries, ¥10,000 for dining out’?”

Setting strict budgets for each individual expense item can feel limiting. Just a few unexpected meals out can throw off your plan, making you think, “I’m already over budget…” This kind of rigid structure often leads to frustration and causes people to give up on financial management altogether.

That’s why KAKEIBO PRO/LiGHT encourages you to manage your budget at the broader Category level—such as ‘Food’—rather than micromanaging each Item. This approach gives you the flexibility to shift funds within the total category budget. For example, you might think, “I saved money by cooking at home this week, so I can treat myself to a nice lunch this weekend.”

At the end of the month, you can still analyze the details using the itemized breakdown to see where your money went. This way, you maintain an overall view without losing sight of specifics.By balancing big-picture budgeting with detailed insights, the two-tier classification system makes financial management both easier to stick with and more effective.

2. Schedule Future Expenses

Do you often find yourself recalculating, “How much money do I have left to spend?” halfway through the month? From rent and utilities to lesson fees and streaming subscriptions, the total amount of fixed monthly expenses adds up quickly—and it’s hard to keep track of everything in your head.

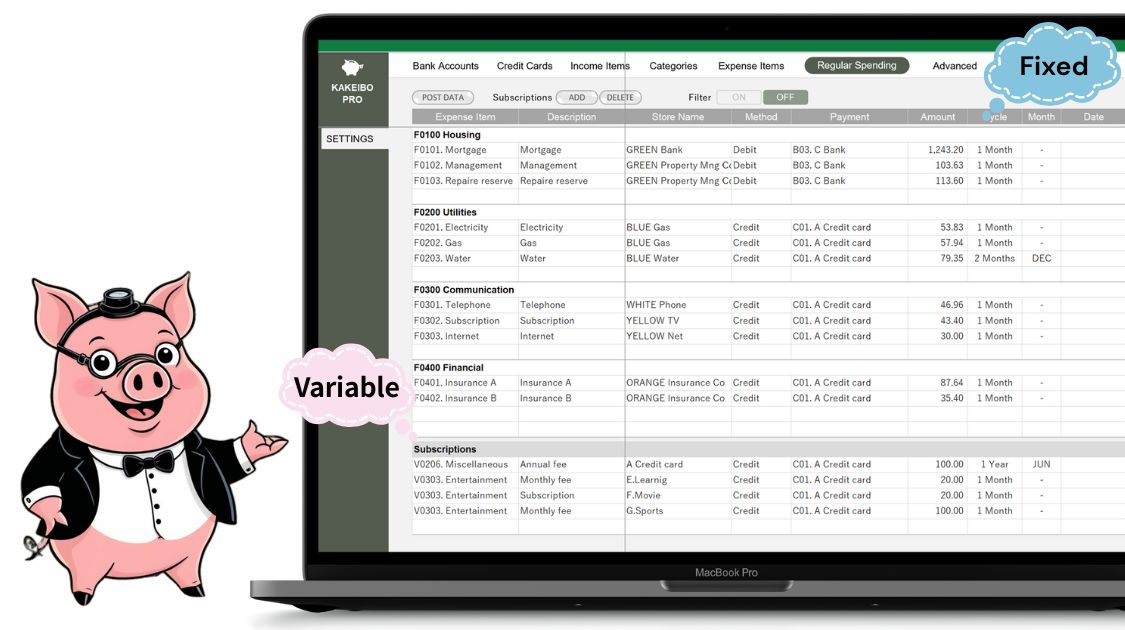

This chapter introduces one of the most important features of KAKEIBO PRO/LiGHT: the ‘Regular Spending’ function, designed to solve this problem once and for all. With this tool, you can pre-schedule your future expenses—such as bills, subscriptions, or any recurring payments.

As a result, the amount of money you can truly use freely becomes clear right from the start of the month. No more guesswork or mid-month surprises—just a clear, manageable budget. Let’s put an end to vague financial anxieties and take full control of your money with scheduled planning.

2-1. What This Feature Solves

I remember my rent and phone bill, but I tend to forget about payments that only happen a few times a year, or subscriptions that are debited on different days each month…

Have you ever experienced this? Many people have been caught off guard by a lower-than-expected bank balance. The ‘Regular Spending’ feature in KAKEIBO PRO/LiGHT is specifically designed to prevent this.

This function lets you pre-register not only fixed monthly costs like rent and insurance, but also expenses that are technically variable yet still occur regularly—like lesson fees or streaming subscriptions. Here are examples of expenses you can register:

- Fixed Costs: Rent, parking fees, insurance premiums, basic phone charges, etc.

- Recurring Variable Costs: Monthly lesson fees, gym memberships, subscription services (video/music), newspaper delivery, etc.

- Irregular or Periodic Payments: Bimonthly water bills, annual NHK (public broadcasting) fees, regular contact lens purchases, etc.

By pre-registering all of your committed expenses—even those that don’t follow a monthly cycle—you eliminate the risk of accidental oversights and gain full control over your cash flow.

2-2. The Biggest Benefit

I get the idea of registering expenses in advance, but how does that actually help with budgeting?

You might be wondering. The greatest benefit of the ‘Regular Spending’ feature is that it allows you to clearly understand how much money you truly have for flexible spending—right from the beginning of the month.

In traditional budgeting, it’s common to use a basic formula like:

Income – Savings Goal = This Month’s Budget

However, this approach often overlooks scheduled expenses—like upcoming bills or subscription fees—which can lead to mid-month surprises when you suddenly realize, “Oh, I forgot that payment was due this month!”

With the ‘Regular Spending’ setting, your budget becomes much more accurate and realistic. You can calculate your discretionary spending for the month as follows:

Income – Savings – Total Scheduled Expenses = Discretionary Spending

Here’s how the total scheduled expenses break down:

- Fixed Costs:

The registered amount becomes the budget and is securely set aside. - Variable Recurring Costs:

After considering the registered variable expenses, the remaining budget for ‘flexible variable spending’ becomes clear.

What’s left is your true, flexible budget—the amount you can freely use for shopping, dining out, entertainment, and other discretionary spending. Since your essential expenses are already accounted for, you can use this remaining amount guilt-free and with confidence.

This approach eliminates the vague anxiety of “How much do I really have left to spend?”

Instead, you gain peace of mind and a practical way to stay within budget—making it a powerful tool for smart, sustainable financial management.

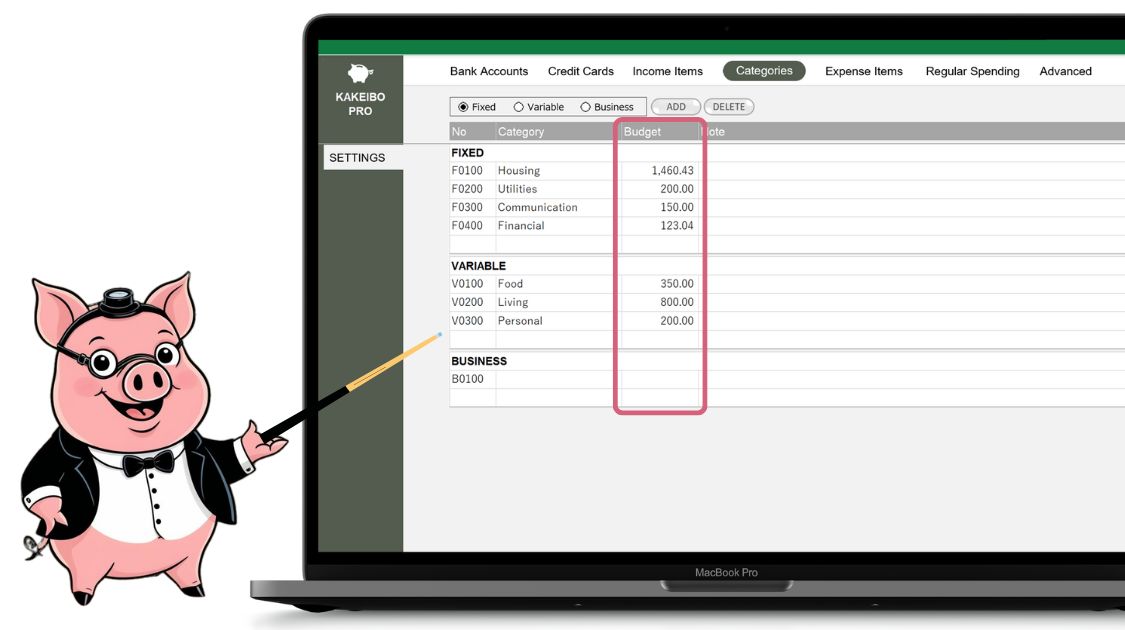

3. Setting Your Budget by Category

Once you understand the basics of using the ledger and how to pre-register expenses, it’s time to tackle the core of financial management: budget setting. However, many people get stuck at this stage, thinking, “I know my income, but how much should I allocate to each item?” As a result, they often settle for vague, rough estimates.

This chapter explains how to set a concrete, personalized budget using KAKEIBO PRO/LiGHT, building on the steps we’ve covered so far. Budget setting—though it may seem complex—becomes surprisingly straightforward when you break it down into two main categories: fixed costs and variable costs.

With that in mind, here are some practical tips to help you create a budget that is both effective and easy to stick with.

3-1. Setting the Budget for the Fixed Costs Category

Budgeting for fixed costs is easy for things like rent, but what about utilities or phone bills that fluctuate slightly each month?

Fixed Costs form the foundation of your household finances. Accurately grasping these costs is the first step toward stable money management. Fortunately, there’s no need to overthink it. The basic principle is simple: Secure the full amount you know will leave your account each month.

In KAKEIBO PRO/LiGHT, the amounts registered under ‘Regular Spending’ (introduced in Chapter 2) can be directly used as your budget.

- For truly fixed amounts (e.g., rent, insurance, parking fees):

Register the exact amount in the ‘Regular Spending’ setting. That’s it—your budget is now set. - For slightly variable amounts (e.g., utilities, communication fees):

A practical approach is to set your budget using:

The average of the past 3–6 months, or

To be extra safe, use the highest recent amount.

For example, if your electricity bill usually ranges from ¥8,000 to ¥12,000, set your budget at ¥12,000.

This way, you avoid the risk of under-budgeting. If the actual bill ends up being lower, the leftover amount becomes a surplus—which you can then put into savings or reallocate to your variable spending.

3-2. Setting the Budget for the Variable Costs Category

Variable costs like food, daily necessities, and social spending are the hardest to control! I always end up overspending without realizing it. How can I figure out the right amount?

Controlling variable costs is both the essence and the biggest challenge of personal budgeting. But with KAKEIBO PRO/LiGHT, you don’t have to rely on guesswork. In fact, even within variable costs, there are two distinct types:

- Scheduled Variable Costs: Regular, recurring costs you’ve committed to—like lesson fees or subscription services.

- Flexible Variable Costs: Daily living costs that vary depending on your lifestyle—like groceries, toiletries, and social outings.

A major strength of KAKEIBO PRO/LiGHT is that it allows you to register Scheduled Variable Costs in the ‘Regular Spending’ setting. This lets you build your budget in three clear steps:

Step 1: Calculate Your Total Variable Cost Budget

First, figure out how much of your monthly income is available for all variable costs:

Monthly Net Income – Savings – Fixed Cost Budget = Total Variable Cost Budget

Step 2: Identify Your True Discretionary Spending

From the total variable cost budget above, subtract your scheduled variable costs (like subscriptions or lesson fees):

Total Variable Cost Budget – Scheduled Variable Costs = Pure Discretionary Costs

This Pure Discretionary Costs is your true flexible budget—the amount you can freely use for food, shopping, outings, and other everyday spending.

Step 3: Allocate the Pure Discretionary Costs by Category

Now, break down that discretionary Costs into specific categories such as: Food, Living Essentials, Entertainment, Miscellaneous Spending. If you have past spending data, use it as a guide. If not, start with a provisional goal and adjust based on your results over the next few months.

4. Compare Budget vs. Actuals

Even the most perfectly crafted budget won’t help if you don’t stick to it. You might think, “I should be on track this month,” only to find yourself facing an unexpected shortfall at the end. The real secret to successful financial management isn’t about creating a flawless plan—it’s about consistent, small actions: Regular daily check-ins.

In this chapter, I’ll introduce two powerful functions in KAKEIBO PRO/LiGHT that make daily tracking simple and effective: ‘Budget Management’ and the ‘Dashboard.’ These features remove the need for manual calculations and allow you to:

- Instantly compare your budget with your actual spending

- Spot early signs of overspending

- Make smart mid-month adjustments before it’s too late

Instead of feeling regret at the end of the month, you’ll be empowered to course-correct in real time—making budgeting a proactive and manageable habit.

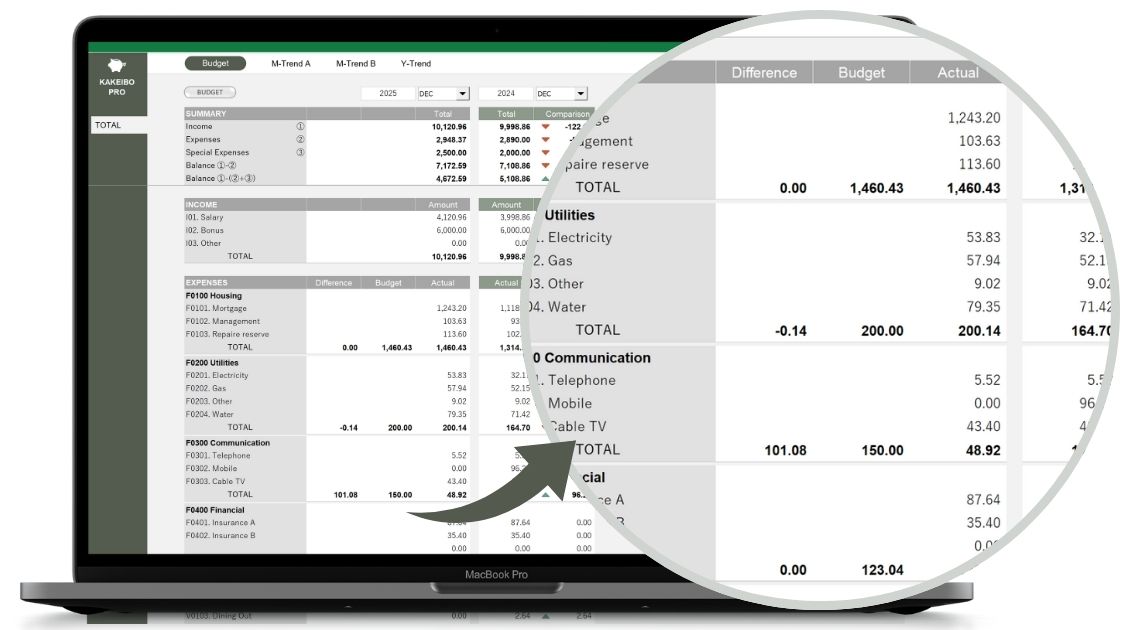

4-1. The Budget Management Feature

I record my daily expenses, but calculating the totals for each category and figuring out how much I have left is such a hassle… I never really know where I stand!

One of the main reasons household ledgers end up as just record-keeping tools—without actually helping you manage money—is the burden of manual tracking and analysis. Simply jotting down what you spent doesn’t naturally lead to better financial decisions.

That’s where KAKEIBO PRO/LiGHT’s ‘Budget Management’ feature comes in. It eliminates the need for a calculator or spreadsheet. Just by entering your daily expenses, the system automatically generates a summary table for each Expense Item and its broader Expense Category. Here’s what the summary shows at a glance:

- Budget: Your planned spending for the category

- Actual Spending: What you’ve spent so far

- Difference: The remaining budget

For example, the ‘Food’ row might display:

Remaining: ¥15,000 | Budget: ¥50,000 | Actual: ¥35,000

This instantly tells you how you’re doing and helps you make concrete, realistic decisions, like: “I have ¥15,000 left for food this month. I’ll skip eating out this weekend and focus on cooking at home.” Whenever you want a clear, data-driven view of your financial status—without crunching numbers yourself—this feature acts as your reliable financial advisor.

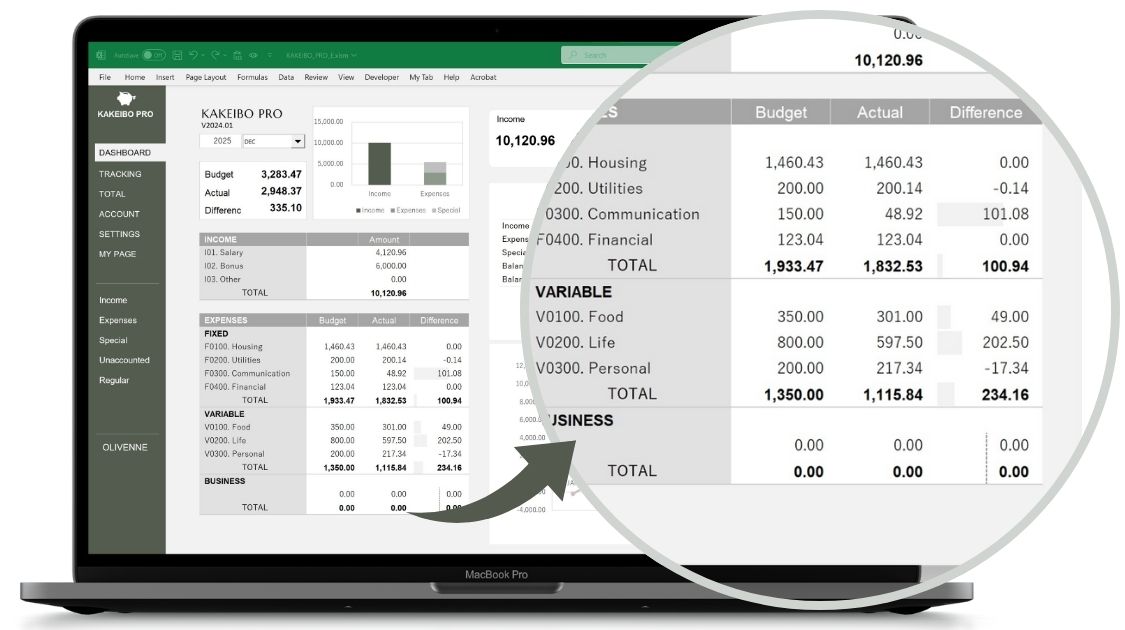

4-2. The Dashboard Feature

I’m not really into tables and detailed numbers… Isn’t there an easier, more visual way to see how I’m doing financially?

Absolutely—and that’s exactly what the ‘Dashboard’ feature is for. Think of it as your financial cockpit—a simple, visual tool that gives you a quick, intuitive overview of your spending, just like a car dashboard helps you monitor your driving.

The key highlight: Dynamic Budget Bars

Each expense category is displayed with a data bar that shows how much of your budget remains.

- At the start of the month, the bar is full.

- As you spend, the bar shrinks, giving you a clear visual cue of how much is left.

For example:

If the bar for your ‘Food’ category is halfway down, it means you’ve already used up 50% of your food budget. No math needed—just glance and know.

This game-like visual system helps you build awareness without effort. You might even catch yourself thinking: “The entertainment bar is shrinking fast… I’ll stay in this weekend.”

Even if you’re busy, checking the dashboard just once a week is enough to spot trouble areas, keep your finances on track, and avoid end-of-month surprises.

5. Conclusion

Throughout this article, I’ve introduced a practical, sustainable budgeting method using the Excel-based household ledger tool KAKEIBO PRO/LiGHT.

If you’ve been struggling with managing your finances, the issue likely isn’t a lack of willpower. More often than not, it’s about using the right method.

The key isn’t to deprive yourself by cutting back on everything. It’s to start by securing the money you’re guaranteed to spend—your fixed and scheduled expenses—right at the beginning of the month. Then, you can clearly see how much is truly available for flexible spending. With KAKEIBO PRO/LiGHT, you get an all-in-one system for successful, low-stress budgeting:

- Two-tier classification (‘Categories’ and ‘Items’) for simple, intuitive recording and tracking

- The ability to pre-schedule fixed and recurring expenses using the ‘Regular Spending’ feature

- A visual dashboard to quickly and intuitively grasp your financial status

You no longer have to live with that lingering question: “How much do I have left to spend?” Why not take the first step today by identifying your fixed and scheduled expenses? I hope this article helps you build a financial plan you can stick with—one that brings both clarity and peace of mind.