Do you diligently track your household spending each month, yet still find yourself wondering, “Where did all the money go?” by the end of the month?

How much do I absolutely need just to get by each month?

How much is actually flexible spending that I can adjust?

Wouldn’t it bring peace of mind to know roughly how much your expenses will be next month?

Perhaps you wish you had a clearer picture like that. Many people want to clearly separate these essential costs from discretionary ones. Also, being able to anticipate future spending makes planning much easier—and far less stressful. If these questions sound familiar, then the Excel budgeting tool KAKEIBO PRO and KAKEIBO LiGHT might be just what you need.

This tool allows you to intuitively classify your expenses into Fixed (Essential) costs and Variable (Flexible) costs. What’s more, its handy Regular Spending Setup feature makes managing future outflows incredibly simple. By registering regular payments—like rent, insurance premiums, or subscriptions—you can easily forecast and manage your upcoming financial commitments.

This article will show you how using KAKEIBO PRO/LiGHT can help you smartly categorize your spending, predict future expenses, and achieve truly planned and confident household financial management.

Language: English Japanese

1. Separating Essentials from Flexible Spending

Even if you keep a budget, do you ever feel like you don’t know where to start? The reason might be that you’re looking at all your expenses in the same way. In this chapter, I’ll introduce a simple first step in financial management: dividing your expenses into two categories — “Essential” and “Flexible.”

By clearly distinguishing between “fixed costs” (those absolutely necessary for living) and “variable costs” (those you can adjust through your own choices), you’ll gain a clearer picture of where you can save. I’ll explain, in simple terms, why this classification directly contributes to improving your finances, along with specific examples.

By the end of this chapter, your cash flow will be better organized, and you’ll see a clear path toward smarter financial management.

1-1. Defining the Classifications

How exactly should I separate Essential and Flexible spending? Rent is obviously essential, but what about utilities that change every month, or my video streaming subscription?

I am here to answer that question. There’s no need to overthink this classification — let’s take a simple approach based on one key question: “Can I control it myself?”

First, Essential (Fixed) Costs are expenses that are absolutely necessary for living and occur regularly, usually every month. These include rent or mortgage payments, insurance premiums, and smartphone bills. The key point is to treat anything indispensable for daily life as essential, even if the amount varies. For example, although your utility bills may fluctuate from month to month, they are still essential for daily living, so I recommend classifying them as Essential (Fixed) Costs.

On the other hand, Flexible (Variable) Costs are expenses you can adjust based on your choices and habits. Typical examples include groceries, daily necessities, social activities, and hobbies or entertainment. For instance, a streaming subscription is considered Flexible (Variable) because you have the option to review or cancel it.

By separating your spending in this way, you can immediately see where you have room to make conscious decisions and reduce your outflow.

1-2. Why Separating Essential and Flexible Spending Improves Your Finances

Honestly, it seems like a bit of a hassle to separate expenses into Essential and Flexible. Will simply classifying them really improve my financial situation?

It’s absolutely worth the effort. In short, this classification is one of the most direct routes to intentional, planned financial management. There are three main reasons why.

Point 1: It clarifies where you should focus your savings efforts

When trying to improve their finances, many people attempt to cut back on everything at once and eventually give up. However, the only area you can meaningfully reduce is your Flexible (Variable) Costs. Once you realize that this is the area to focus on, you’re freed from aimless saving. You can then take effective, sustainable actions—like dining out less often or canceling unnecessary subscriptions.

Point 2: It provides peace of mind

By knowing the total amount of your Essential (Fixed) Costs, you create a mental safety net: “As long as I secure this amount each month, my basic needs are covered.” This awareness reduces vague financial anxiety and allows you to go about your daily life with greater confidence and less stress.

Point 3: It clarifies your spending priorities

Within the budget you’ve set aside for Flexible (Variable) Costs, what do you want to enjoy most? A meal with friends, a favorite hobby, or a treat for yourself? By being mindful of this breakdown, what truly matters to you becomes clearer. You’ll naturally start making conscious choices like, “It’s okay to splurge a little here,” or “I’ll hold back on that.” This awareness dramatically increases your satisfaction with each spending decision.

2. Predict Your Monthly Spending with the Regular Spending Setup Feature!

Do you ever feel anxious about the uncertainty of future expenses, wondering, “How much money will I actually be spending next month?” It’s not just fixed costs like rent — there are also many recurring expenses, such as monthly subscription fees, that effectively act as fixed commitments.

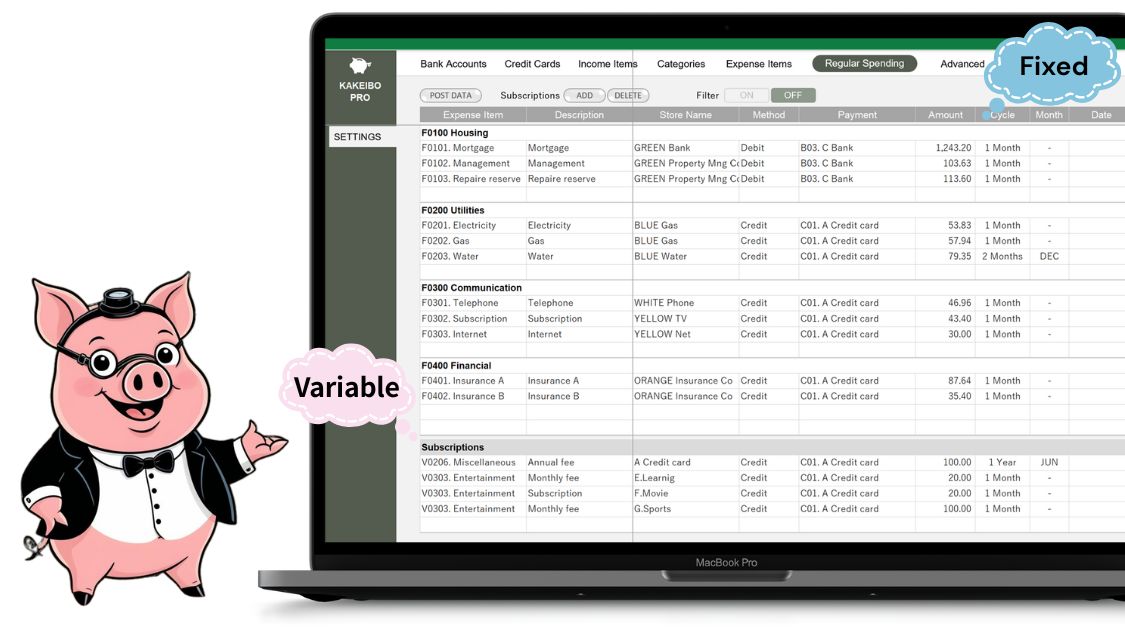

In this chapter, I’ll introduce the Regular Spending Setup feature available in the Excel budgeting tools KAKEIBO PRO / LiGHT. This feature allows you to pre-register not only your fixed costs but also recurring variable expenses, helping you estimate your total monthly spending in advance.

I’ll explain in detail how visualizing your future spending can free you from vague financial anxiety and help you achieve a more planned, stress-free approach to household management.

2-1. What Is the Regular Spending Setup Feature?

I understand that rent and insurance are fixed costs, but how should I handle things like my monthly streaming service fee or gym membership?

They’re flexible expenses, but the payments are fixed. I want an accurate picture of the total money that goes out every month, including these.

The Regular Spending Setup feature, included in KAKEIBO PRO / LiGHT, is designed to solve exactly this problem. As the name suggests, this function allows you to pre-register expenses that occur on a regular basis — whether monthly, bimonthly, or annually. Items classified as Essential (Fixed) Costs, such as rent and communication fees, are automatically added to this list.

What makes it even more convenient is that you can manually add items that are Flexible (Variable) but have regular payments, such as subscription services. This enables you to accurately capture the total amount of money that effectively goes out each month — something you can’t see by looking at fixed costs alone.

In short, it’s an incredibly useful feature that bridges the gap between fixed and variable costs, allowing you to manage all your recurring payments in one place.

2-2. The Biggest Benefit of This Feature

Pre-registering expenses sounds convenient, but how will it actually change my budgeting? Can I really stop budgeting by guesswork?

In short, the greatest benefit of this feature is that it allows you to predict your future expenses—and, in doing so, frees you from financial anxiety.

Imagine starting the month knowing, “This month, I’ll need exactly X amount for my recurring expenses.” What happens then? That vague worry of “Will I have enough money?” turns into a sense of security grounded in concrete numbers. This clarity creates significant mental breathing room.

Furthermore, being able to see into the future enables more strategic spending. You can make forward-thinking decisions such as, “My recurring expenses are high this month, so I’ll cut back on dining out,” or “Next month looks lighter, so I can finally buy that thing I’ve been wanting.” This isn’t reactive saving—it’s the first step toward proactive, strategic financial management.

Additionally, by registering infrequent but predictable expenses—like annual membership fees—you can prevent missed payments and avoid the stress of unexpected large bills. Once you master this feature, you’ll no longer be at the mercy of your expenses; instead, you’ll manage them with clarity and confidence.

3. Setting Up Your Expense Items in KAKEIBO PRO / LiGHT

Understanding the importance of classifying expenses is one thing—but when you’re actually sitting in front of a budgeting tool, it’s easy to wonder, “Where do I even begin?”

Welcome to the practical guide! In this chapter, I’ll walk you through how to create your own personalized, easy-to-use budget with KAKEIBO PRO / LiGHT in three simple steps.

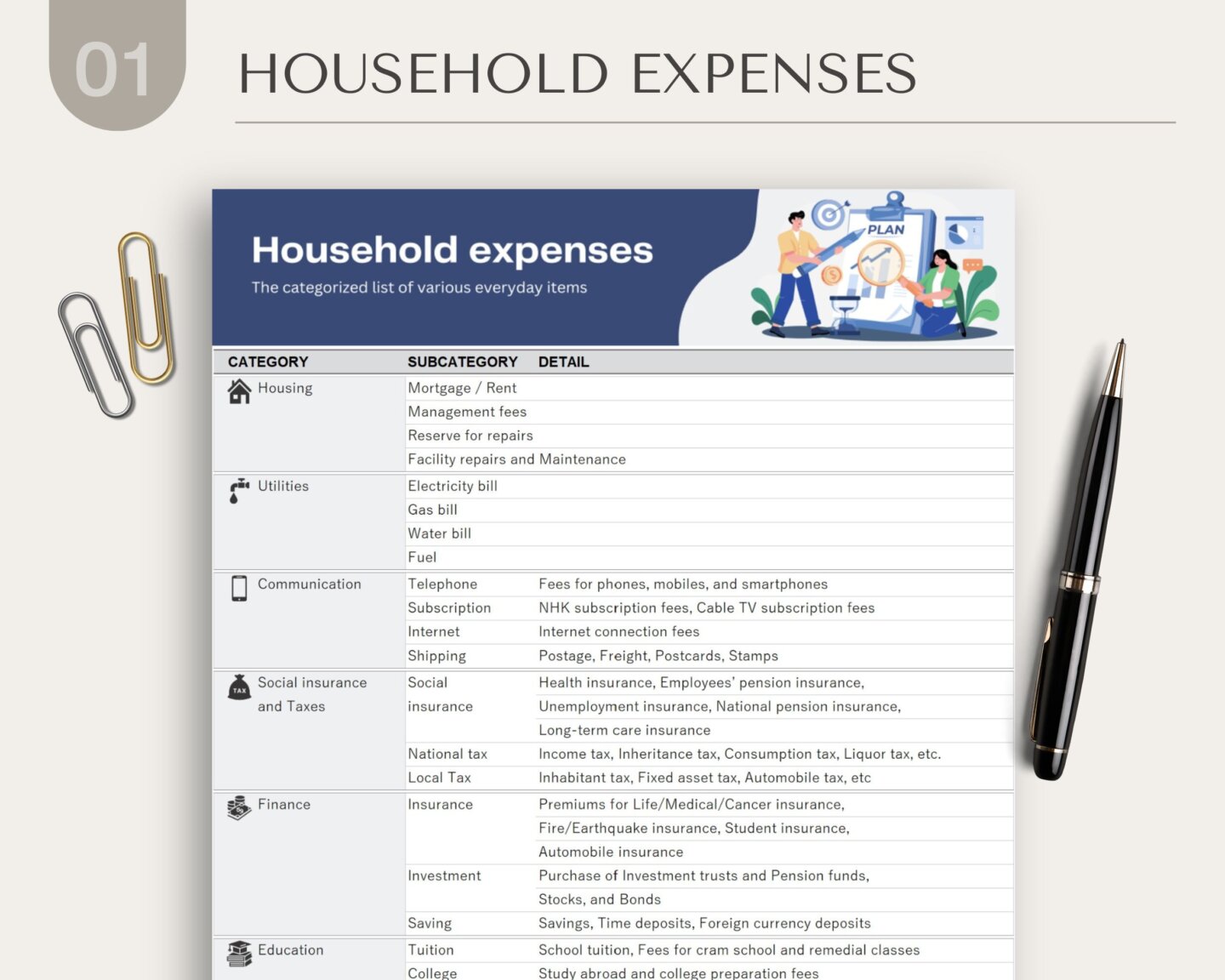

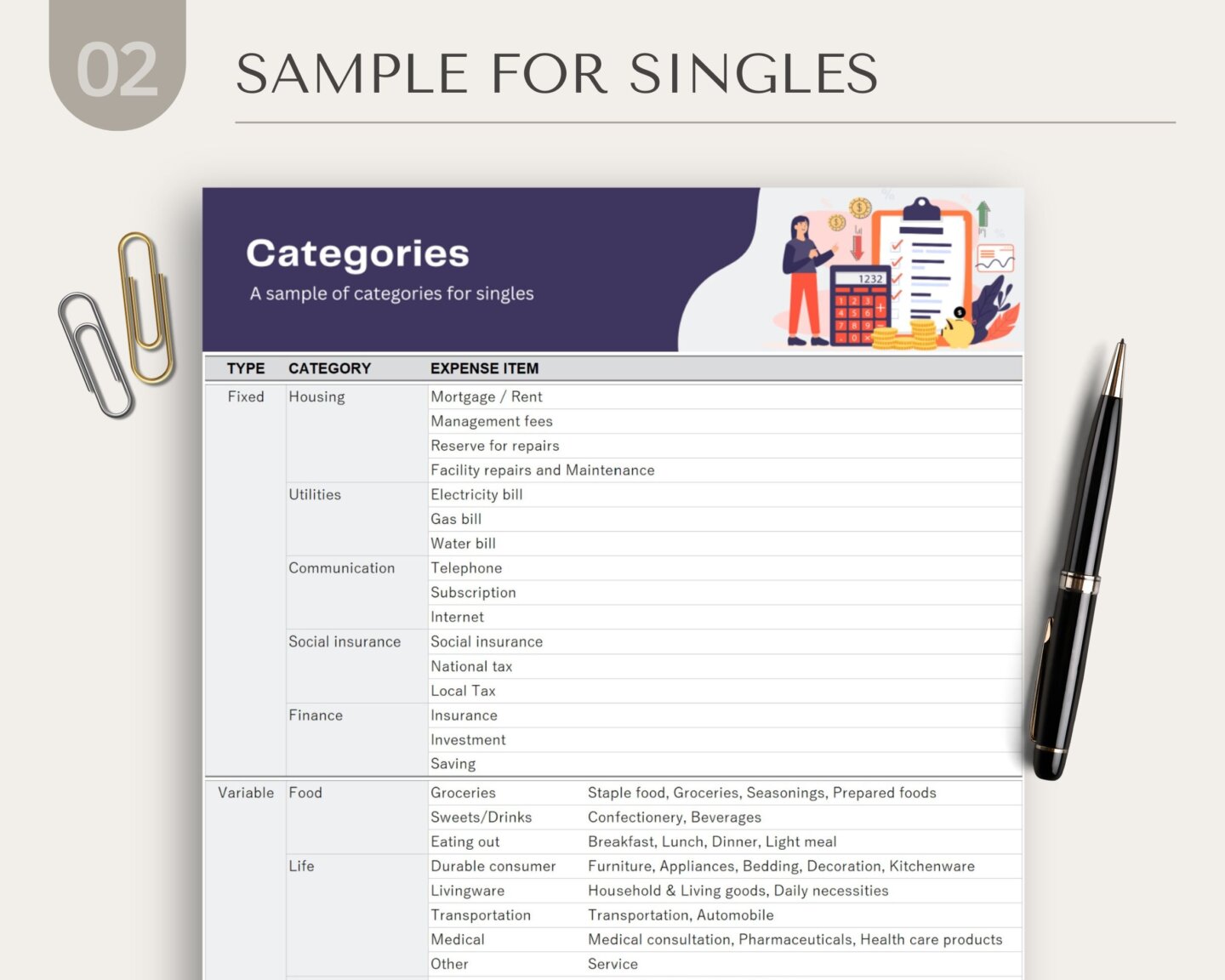

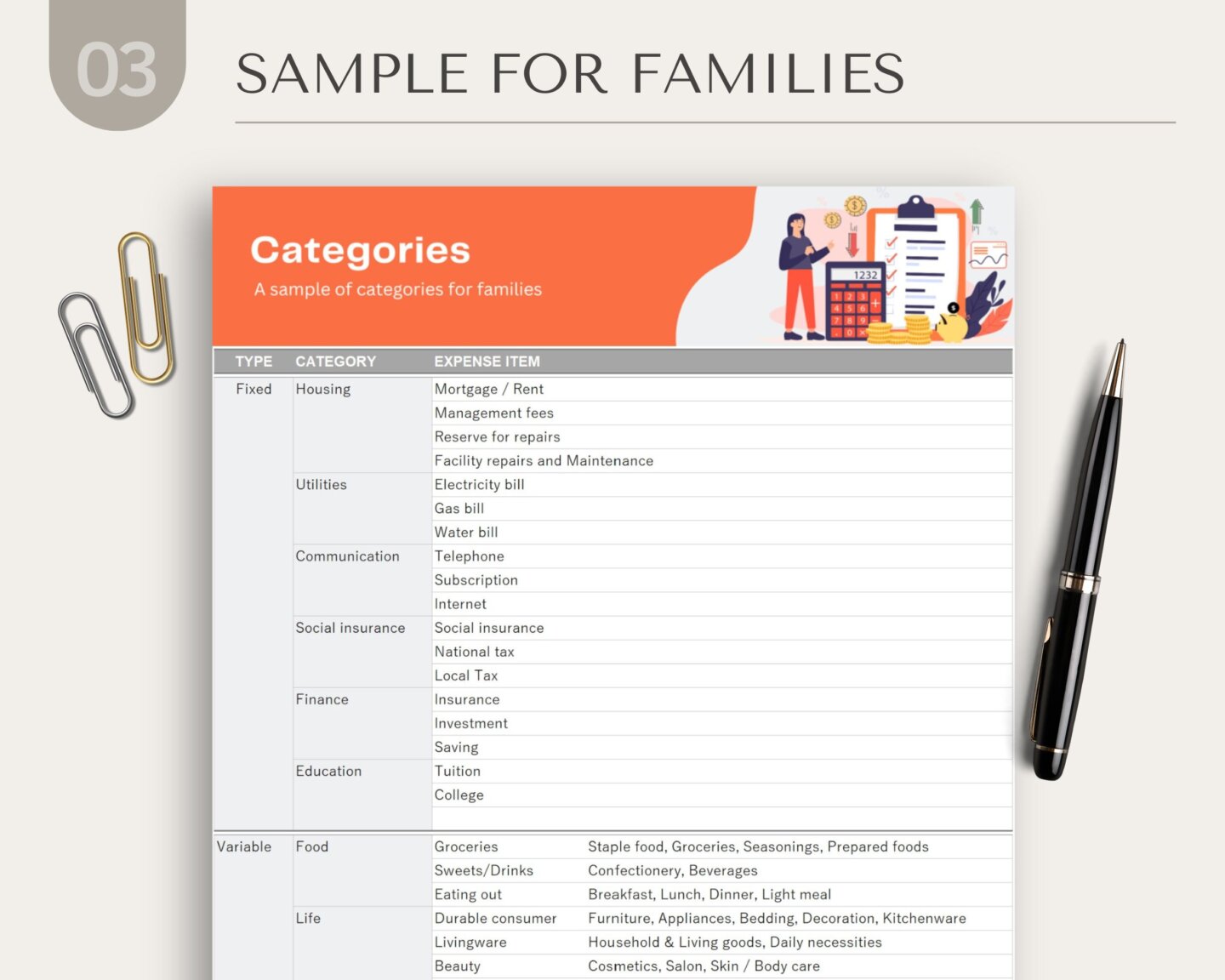

First, you’ll define your broad “Categories”, then set up your specific “Expense Items”, and finally, register your “Recurring Expenses”. Thanks to the flexibility of Excel—and the bonus “Category List” included with your purchase—even beginners can complete the setup without confusion. Let’s get started!

3-1. Setting Up Your Expense Categories

I’ve heard that if a budget has too many detailed items, it becomes hard to stick with. How should I create the main groups at the beginning? I’m not sure how to categorize expenses for my own lifestyle.

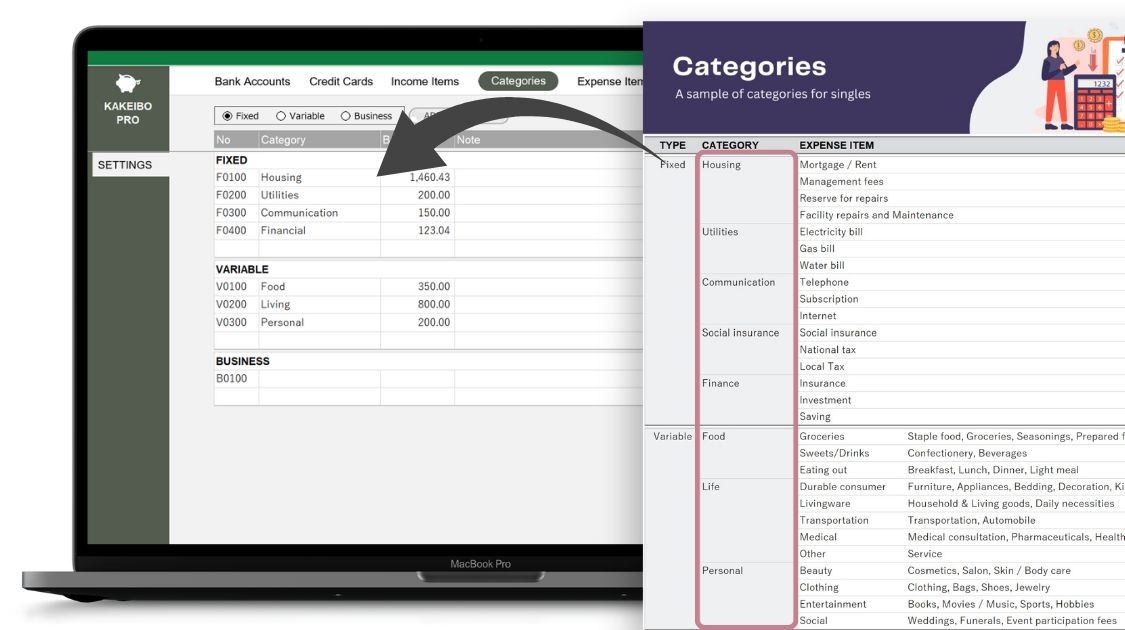

The first step in financial management is to decide on the broad groups for your expenses—your “Categories.” There’s no need to overcomplicate things. To start, let’s build a simple framework based on the Essential (Fixed) and Flexible (Variable) concepts introduced in Chapter 1.

With KAKEIBO PRO / LiGHT, you can freely customize these categories to match your lifestyle. For example, you might set up basic categories such as Housing, Utilities, and Insurance for fixed costs, and Food, Household Supplies, Social, and Hobbies / Entertainment for variable costs. You can also add original categories like Pet Care or Self-Investment—anything that helps you better understand your cash flow.

If you’re unsure how to classify certain items, the Category List provided as a bonus with your purchase will be a great help. This file includes a sample list of expense items already organized into fixed and variable costs. Use this list as a reference to speed up your setup and get started with confidence.

3-2. Setting Up Your Expense Items

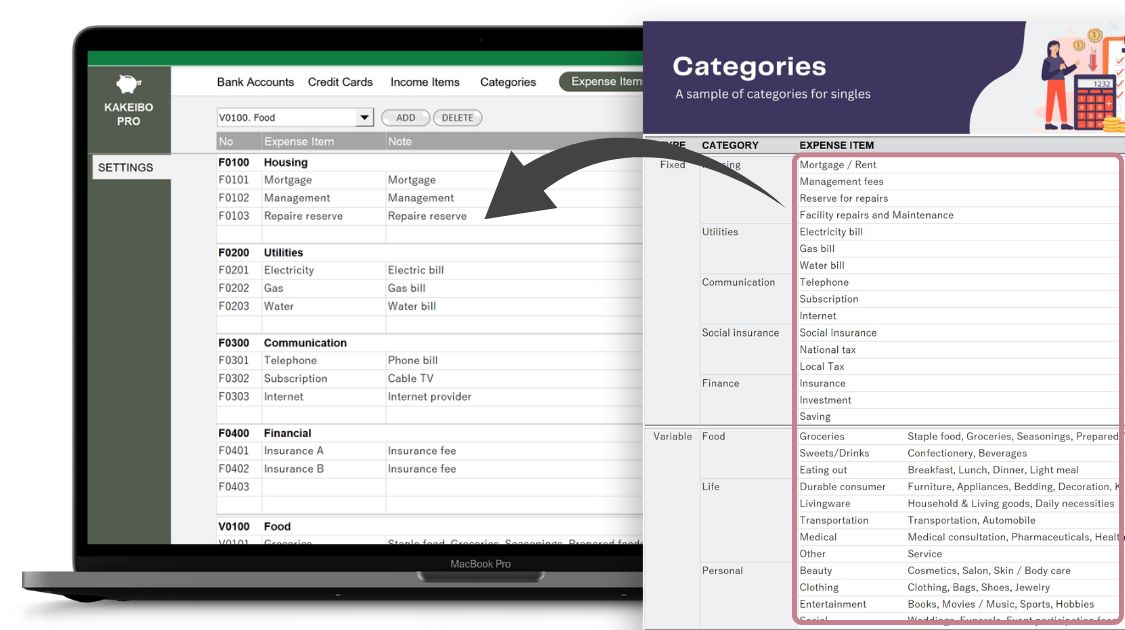

I’ve decided on the categories, but how detailed should the expense items within them be? It makes sense to split Food into Groceries and Dining Out, but should I go even more granular?

Once your broad categories are set, the next step is to define the specific “Expense Items” within them. This step is essential for understanding your personal spending habits.

For example, within the Food category, you might create items such as Groceries, Dining Out, and Cafes. This allows for more detailed analysis later—helping you notice patterns like, “I spent quite a lot on dining out this month.”

But how detailed do I need to be?

Setting up an item for every single purchase sounds exhausting…

That’s where the Category List included with your purchase comes in handy. This file contains an extensive collection of examples showing how various everyday goods and services can be classified—from groceries and daily necessities to leisure activities.

When you find yourself wondering, “Which item should this expense go under?” this list serves as a reliable guide. For instance, you’ll see that “lunch at a café” can be classified under Dining Out in the Food category, while “buying a lightbulb” fits under Household Supplies in the Living Expenses category.

By referring to this list, you can eliminate much of the confusion over “Which category? Which item?” and set up your expense items quickly and confidently. Of course, the list is just a reference—feel free to customize it to the level of detail that best suits your lifestyle, either by selecting existing items or adding your own.

3-3. Setting Up Your Regular Spending

I learned about Regular Spending in the last chapter, but how do I actually register them? It seems like rent and other fixed costs are set automatically—but what about my monthly streaming service or class fees?

Once your categories and items are set, the final step is to configure your “Regular Spending.” Doing this will dramatically improve the accuracy of your future spending forecasts.

The setup is very simple. Items you’ve classified as Fixed Costs—such as rent and insurance—will automatically appear on the list. This covers most of your monthly Essential spending.

Next, you’ll manually add items that are Variable but have regular payments, such as streaming services, gym memberships, or class tuition fees. Simply enter the payment date and amount to complete the registration.

With that done, you’ll have a clear overview of all the money that regularly leaves your account, effectively bridging the gap between fixed and variable costs. This small step will become a powerful ally when planning your budget for the following month.

4. Conclusion

In this guide, we’ve explored two essential steps for successful financial management—”classifying your expenses” and “predicting your future spending”—using the Excel budgeting tools KAKEIBO PRO and KAKEIBO LiGHT.

First, by separating your daily expenses into Essential (Fixed) and Flexible (Variable) categories, you can identify where there’s room to save and gain the peace of mind that comes from knowing the minimum amount you need to maintain your lifestyle.

Next, by using the Regular Spending Setup feature, you can anticipate how much money you’ll need not only next month but in the months ahead. By visualizing your future spending, vague financial anxiety fades away, and you can begin managing your money in a more planned and balanced way.

If you’ve ever felt uncertain about your finances—thinking, “I never seem to have enough money,” or “I want to manage my money more strategically, but I don’t know where to start,”—then KAKEIBO PRO / LiGHT will help bring clarity to both your current situation and your financial future.

Use the bonus Category List as your guide, and start setting up your own household budget today. You’ll be taking the first concrete step toward controlling your spending—and living the life you truly want.