KAKEIBO PRO provides useful features to manage your credit card and bank accounts. It allows you to manage your credit payments, reconciliation of credit card payments, and bank account deposits & withdrawals efficiently. In particular, “Credit Card Payment Reconciliation” is an original feature not found in other applications, and it reconciles the amount charged by the credit card company based on the credit card usage details entered into KAKEIBO. This prevents oversights and errors, and effectively checks for unauthorized use of credit cards.

Take the first step toward safe and accurate household fiscal management and protect yourself from unauthorized use. This guide shows you the features of credit card and bank accounts management.

Language: English Japanese

–

1. Credit Card Management

One of features to manage credit card payments is “Credit Card Payment Reconciliation.” It reconciles the credit card usage details entered into KAKEIBO with the amount charged by your credit card company.

It takes a lot of time and effort to check each statement one by one. This tool reduces this time-consuming task by automatically reconciling each statement.

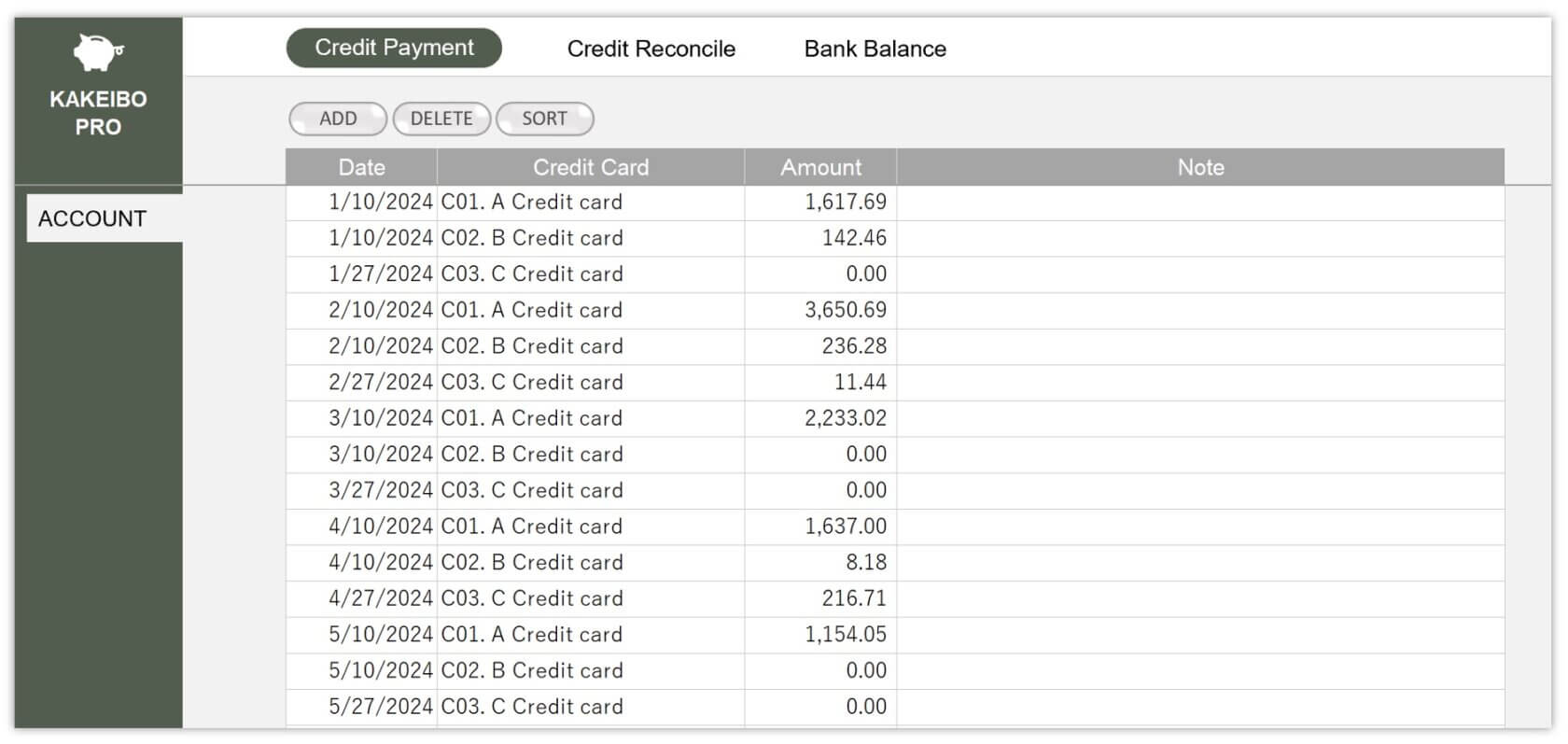

1-1. Entering Credit Card Billing Amount

On this sheet, you will enter billing data based on the credit card statement from the credit card company. Click on ACCOUNT in the main menu, then Credit Payment under the ACCOUNT group, and enter the data in the sheet below.

| Date | Enter the settlement date. Required |

| Credit Card | Select the relevant credit card from the drop-down list. Required |

| Amount | Enter the amount charged by the credit card company. Required |

| Note | Enter any notes you wish. |

Adding Data

Click the ADD button to add a new row for entering data.

Deleting Data

Click the DELETE button to delete the last data.

Sorting Data

Click the SORT button. It sorts the data in ascending order based on 1 Date and 2 Credit Card.

–

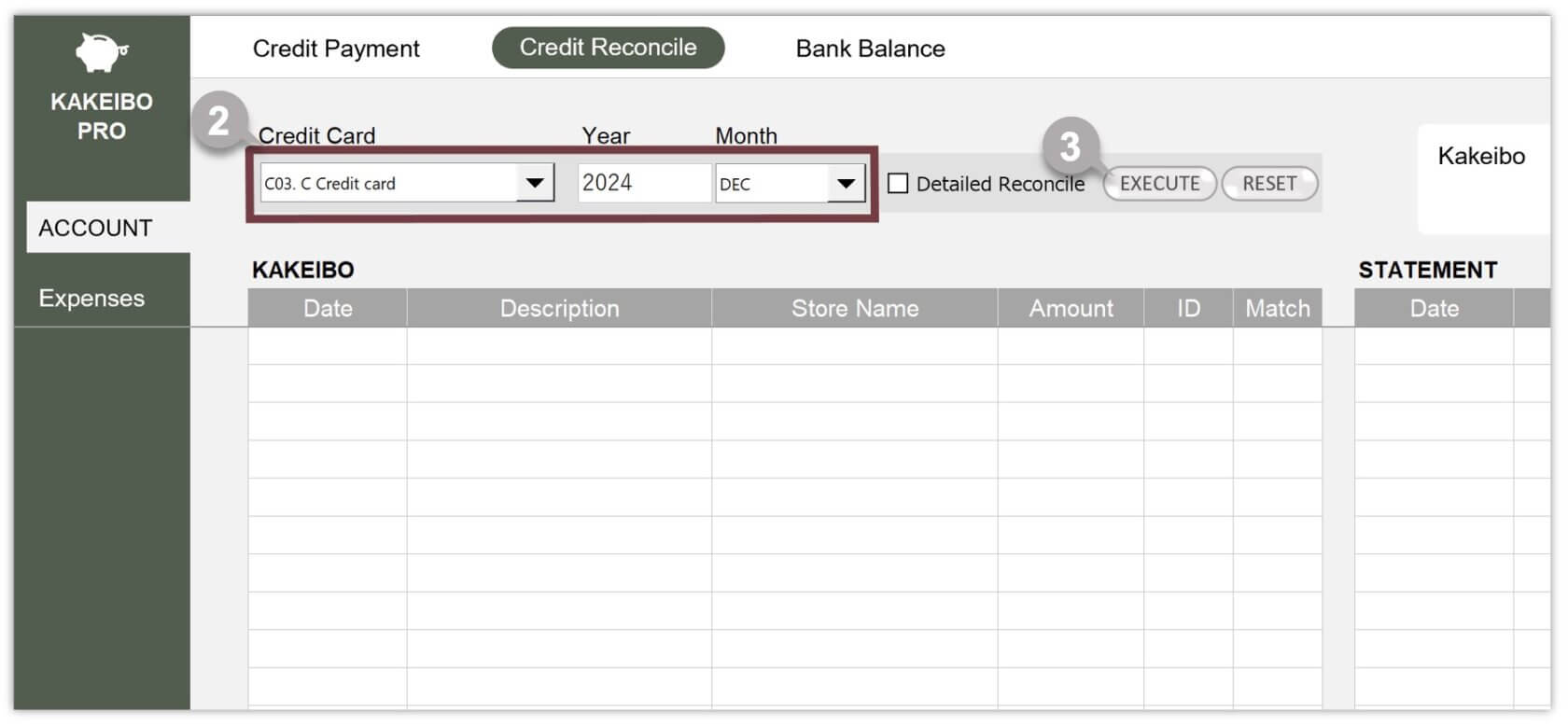

1-2. Simple Data Reconciliation

It aggregates the credit card usage amounts entered into KAKEIBO and reconciles them with the amount charged by the credit card company. Simple reconciliation is useful when credit card usage is low. Here are the steps for simple data reconciliation:

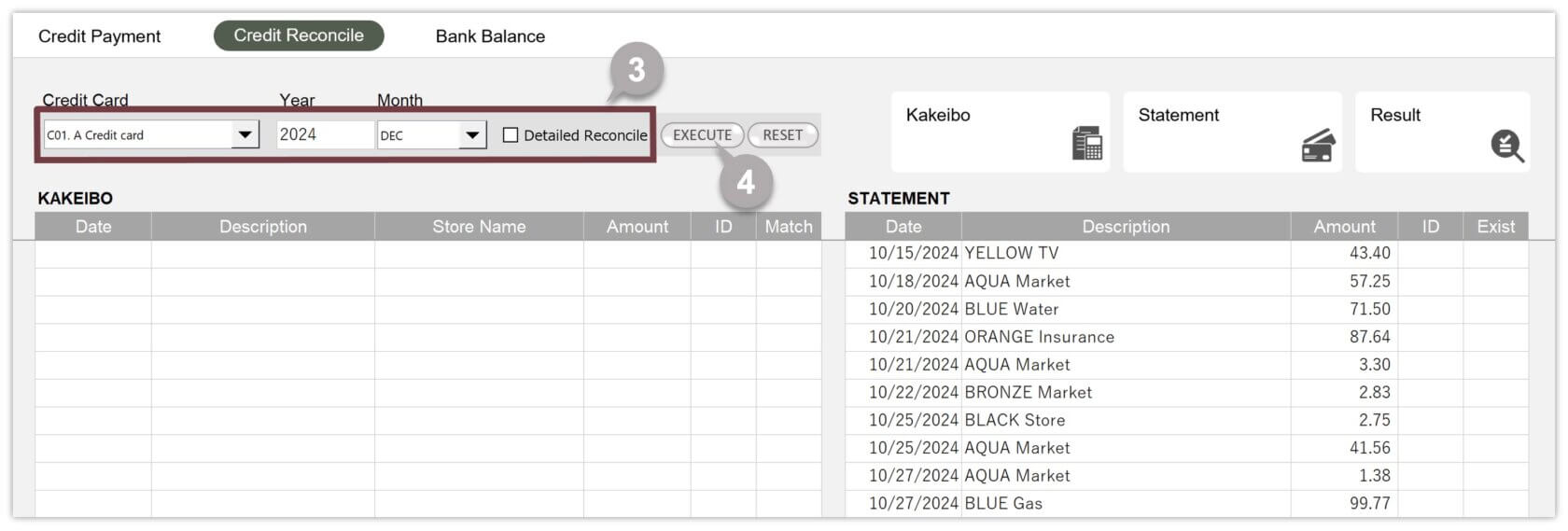

1 Click on Credit Reconcile under the ACCOUNT group.

2 Specify the target credit card, year, and month.

3 Click the EXECUTE button.

4 A confirmation message will appear. Click OK.

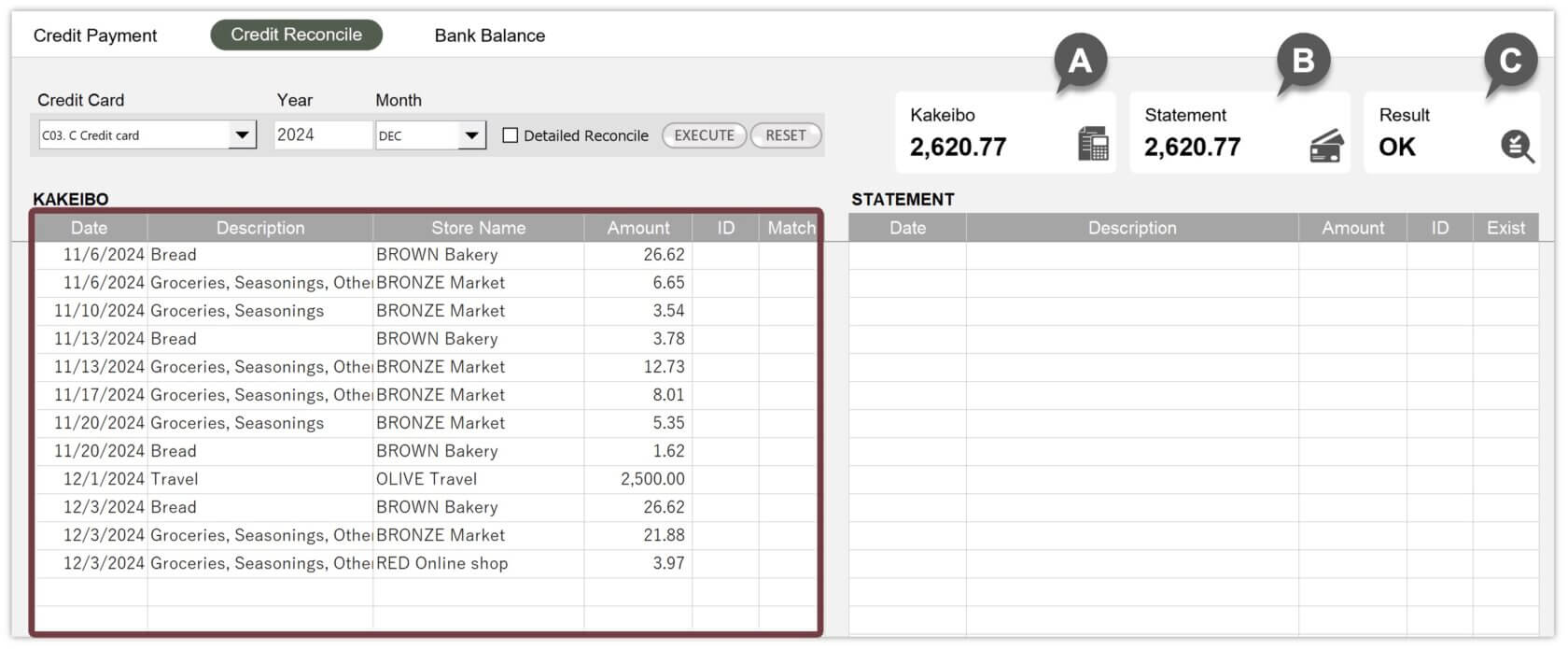

5 It will display the reconciliation results and expenditure details.

| A Kakeibo | The total amount of the details listed in KAKEIBO. |

| B Statement | The amount charged by the credit card company. |

| C Result | It displays “OK” for a match, “Check” for a mismatch. |

1-3. Detailed Data Reconciliation

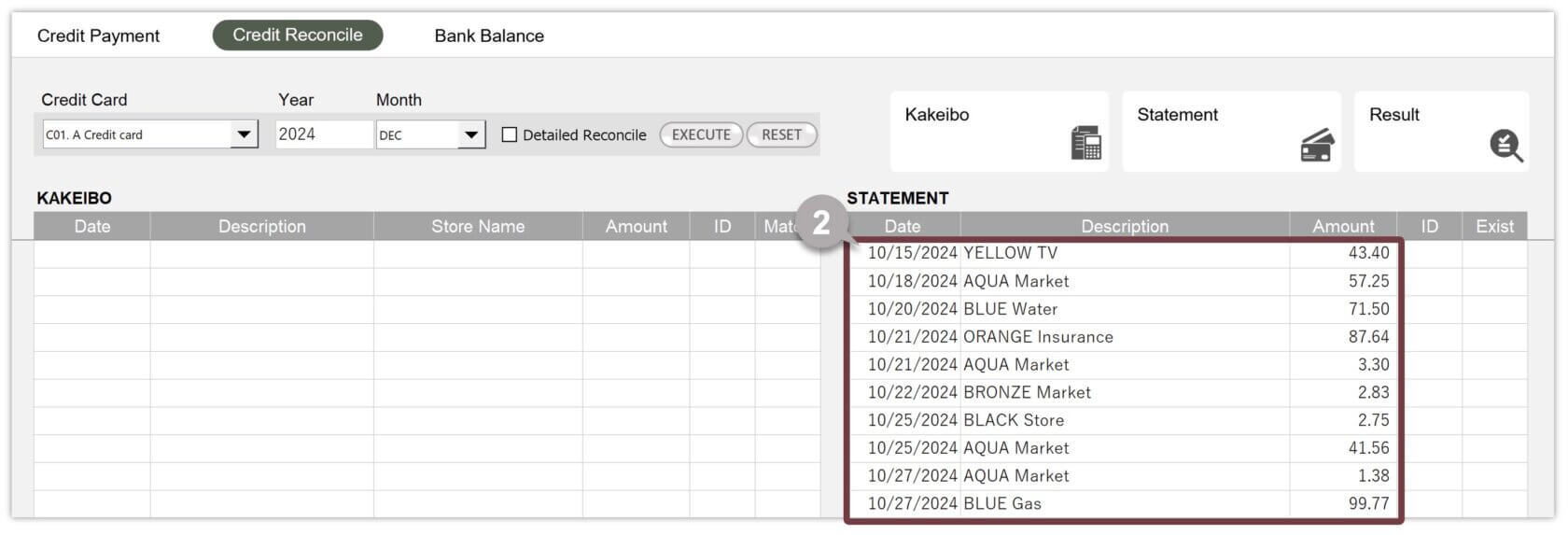

This tool reconciles the credit card usage details entered into KAKEIBO with the billing statement from the credit card company one by one. You can check whether there are any discrepancies between the details entered into KAKEIBO and the statements from your credit card company. The detailed reconciliation requires the statement data in text format. Please download the statement data in CSV file format from the credit card company’s website. Here are the steps to reconcile detailed data:

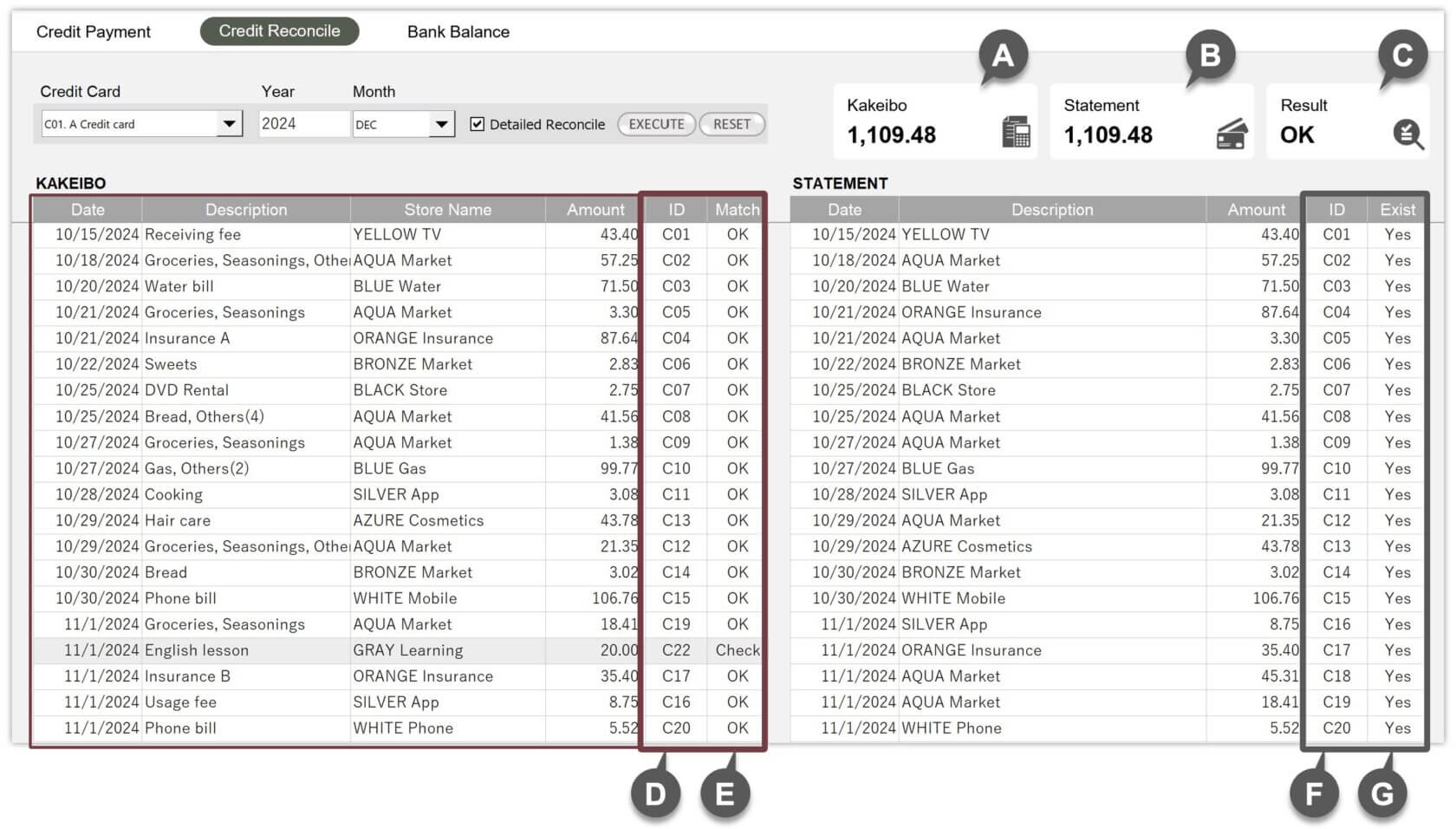

1 Click on Credit Reconcile under the ACCOUNT group.

2 Open the downloaded statement data file. Copy the date, description, and amount, and then paste them into the STATEMENT list.

3 Specify the target credit card, year, and month. Check the Detailed Reconcile box by clicking.

4 Click the EXECUTE button.

5 A confirmation message will appear. Click OK.

6 It will display the reconciliation results and expenditure details.

| A Kakeibo | The total amount of the details listed in KAKEIBO. |

| B Statement | The amount charged by the credit card company. |

| C Result | It displays “OK” for a match, “Check” for a mismatch. |

| D ID | It displays the ID number of the matched credit card statement. |

| E Match | It displays “OK” if the date and amount match, “Check” if there is no match or only the amount matches. It highlights the statements marked “Check.” |

| F ID | It automatically numbers the entered statements. |

| G Exist | It displays “Yes” if there is any relevant data in KAKEIBO list, and “No” if there is no relevant data. It highlights the statements marked “No.” |

1-4. Checking Reconciled Data

Based on the reconciliation results, you will check whether the details entered into KAKEIBO match with the statement from the credit card company.

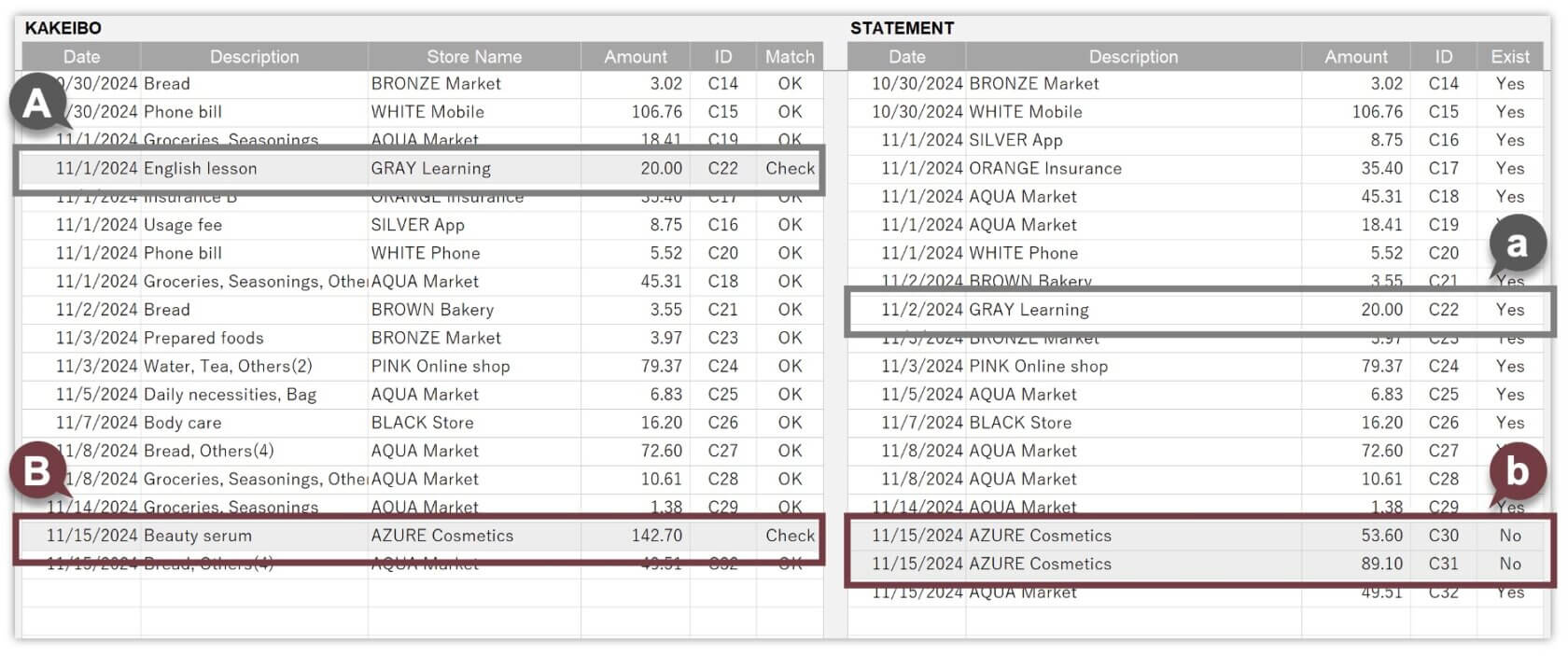

Checking A and a

1 Check if the statement with ID “C22” is in the STATEMENT list.

2 It has “GRAY Learning” in the Store Name column of the KAKEIBO list for ID “C22”. You can see “GRAY Learning” in the Description column of the STATEMENT list for ID “C22” and the amounts match, hence we consider A and a to be the same.

3 Enter “OK” in the Match column of the KAKEIBO list. It will deactivate the highlighting.

Usage Date on the Statement

The usage date on your credit card company’s statement may be different from the date you actually used your credit card.

–

Checking B and b

1 Search for the statement corresponding to the store name “AZURE Cosmetics” from the STATEMENT list.

2 There is “AZURE Cosmetics” in the Description column for IDs “C30, C31”, and the amount in B and the total amount in b also match, hence we consider B to be a statement under IDs “C30, C31”.

3 Enter “OK” in the Match column of the KAKEIBO list, and “Yes” in the Exist column of the STATEMENT list. It will deactivate the highlighting.

–

1-5. Benefits of Credit Card Payment Reconciliation

Credit card payment reconciliation offers the following benefits:

Identify data entry errors.

Detect unauthorized use of credit cards.

–

If there is discrepant data, there may be an input error in the expenditure data; please check the expenditure data, payment date, etc. If you find an unfamiliar statement in the credit card statement list, it is likely that your credit card has been used fraudulently. In this case, please contact your credit card company.

–

2. Bank Account Management

On this sheet, you can view a list of aggregated deposit & withdrawal details and total amounts by specifying the target bank account, year, and month. You can also download detailed deposit and withdrawal data, which is useful for managing account balances.

2-1. Aggregating Deposits and Withdrawals

Based on the data entered into KAKEIBO, it aggregates deposits and withdrawals for the specified bank account, and lists the total amount and details. This function is useful for keeping track of bank account balances. Here are the steps to use this function:

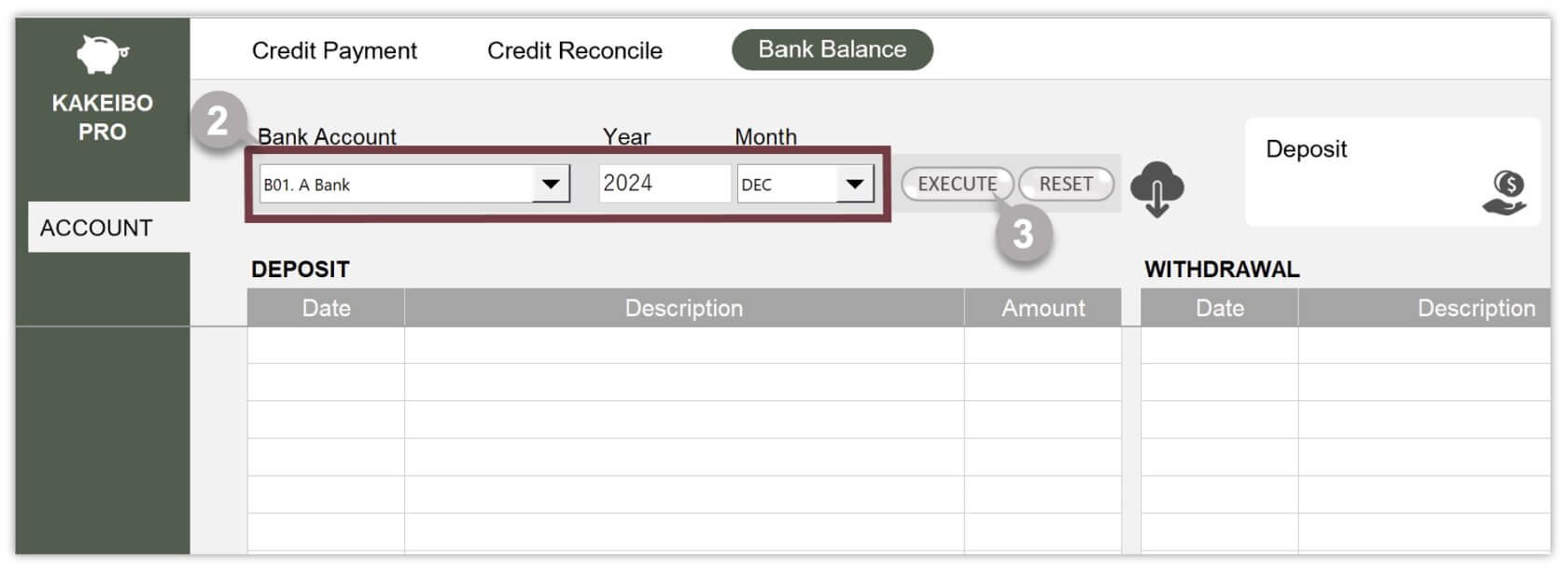

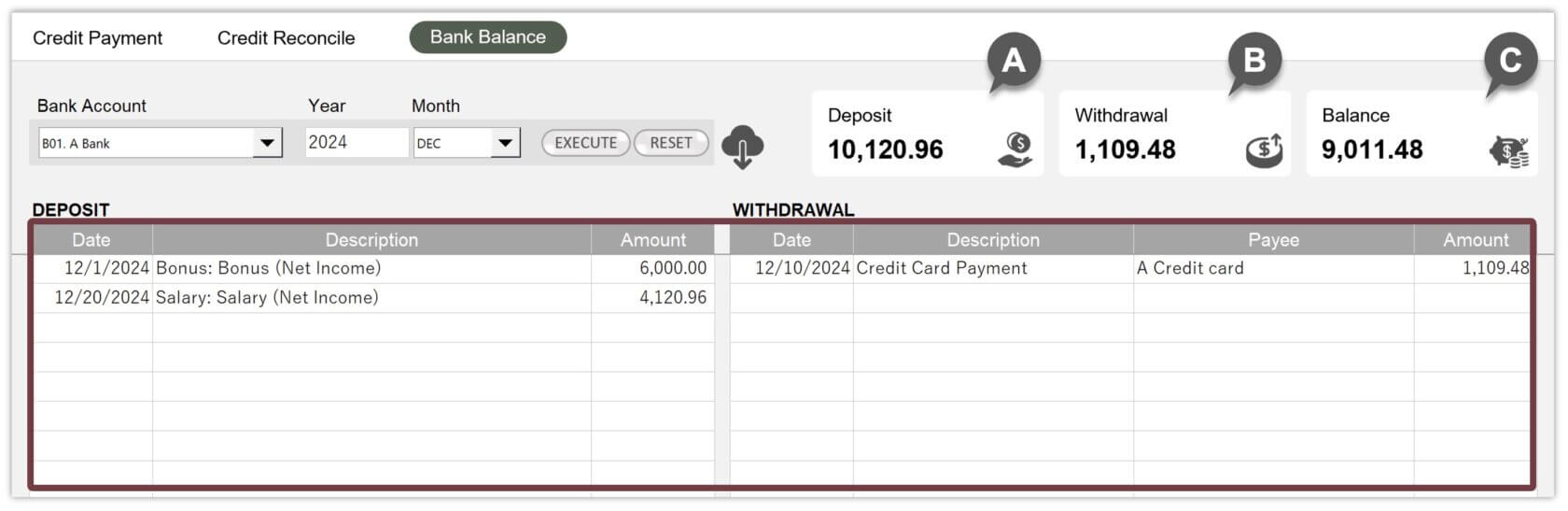

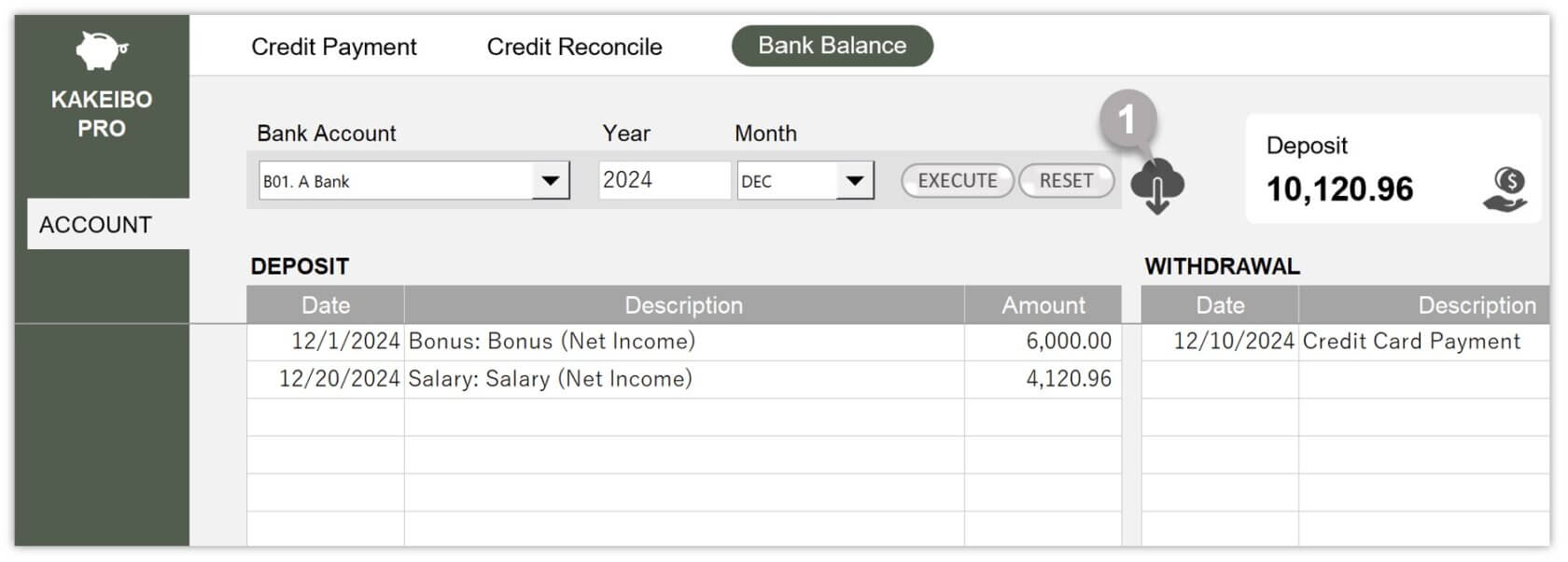

1 Click on Bank Balance under the ACCOUNT group.

2 Specify the target bank account, year, and month.

3 Click the EXECUTE button.

4 A confirmation message will appear. Click OK.

5 It will display the deposit & withdrawal details and the total amounts.

| A Deposit | The total amount of the deposit details. |

| B Withdrawal | The total amount of the withdrawal details. |

| C Balance | The amount after subtracting withdrawals from deposits. |

2-2. Exporting Deposit and Withdrawal Data

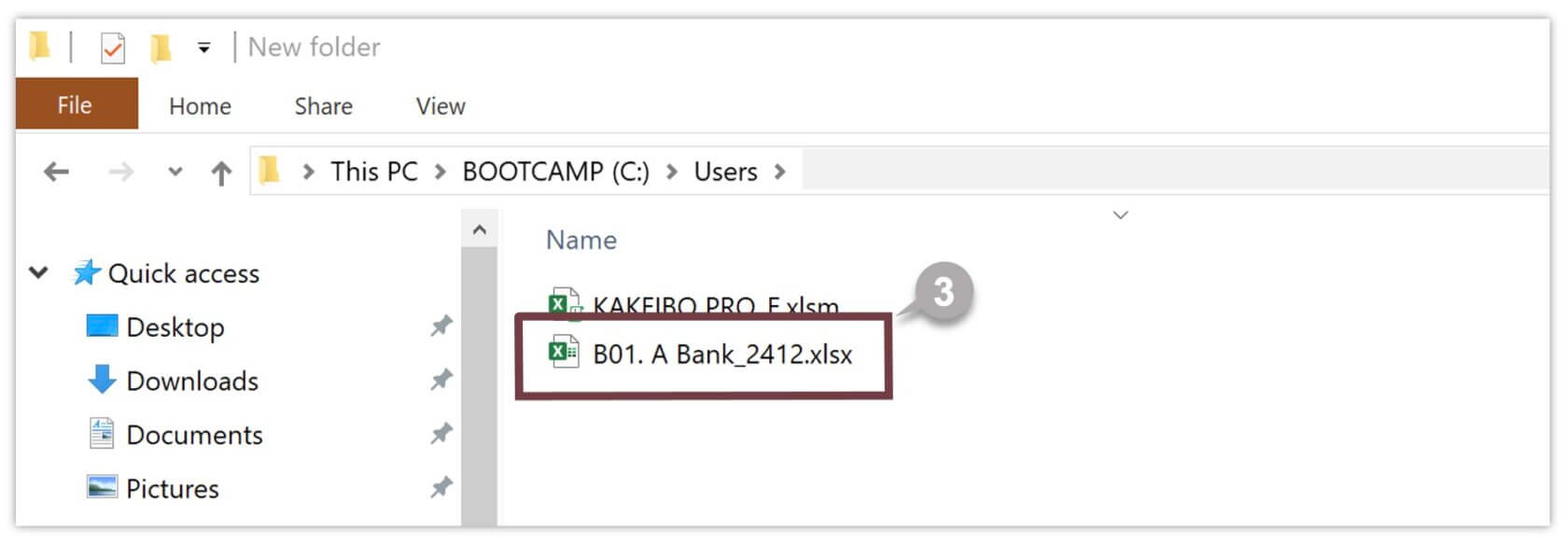

It allows you to download the listed deposit and withdrawal detail data. It is useful to use this data to manage bank account balances. Here are the steps to download the data:

1 Click the icon for download.

2 A confirmation message will appear. Click OK.

3 It will save the file under the name “Control No. Bank Account Name_YYMM.xlsx” in the folder where the tool is saved.

Reset

In the Credit Reconcile sheet and the Bank Balance sheet, they have the RESET button. You can clear all data and return to the initial state by clicking it.